The logistics of energy resources will stabilize in 2023. MOEX will weaken

By: Marek Grzybowski

If the prices of basic energy resources remain low, the Russian economy and the operators of tankers and bulk carriers will feel it.

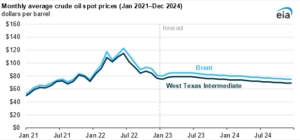

“In our January 2023 short-term energy outlook, we project the price of Brent crude oil to increase from an average of $81 a barrel in December 2022 to an average of $83 a barrel in the first quarter of 2023,” EIA informed in a February analysis.

The EIA forecasts that the Brent price will remain relatively stable in Q2 2023, averaging $85 per barrel, before declining until the end of 2024. For oil exporters, it is not good news that the Brent price will average USD 83 this year. and $78 in the next. For comparison, in 2022 it was $101.

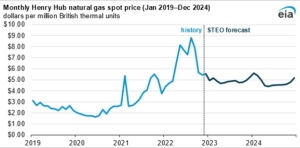

The EIA’s January Short-Term Energy Outlook (STEO) predicts the Henry Hub natural gas spot price to average $4.90 per million British thermal units (MMBtu) in 2023. This will be over $1.50/MMBtu less than the 2022 average. The EIA also forecasts that prices will stay pretty much the same in 2024 as natural gas production in the United States continues to grow. Gas production exceeds domestic demand for natural gas and exports for most of the year.

The above information allows us to conclude that the economic sanctions will be increasingly felt by the Russian economy as a result of the stabilization of energy commodity prices at a relatively low level. Importers of energy resources, such as Poland, can expect the situation on the market to improve, and thanks to lower prices in their economy, they will catch their breath after the turbulence related to the change of supply sources in 2022. Ports will play an important role in ensuring the economic security of many countries, including Poland, as never before.