Shipbuilding industry in South Korea. Business under the government umbrella

Source: https://pulsenews.co.kr

Source: https://pulsenews.co.kr

By Marek Grzybowski

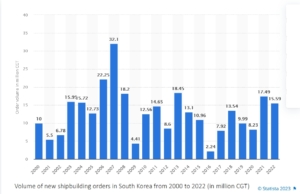

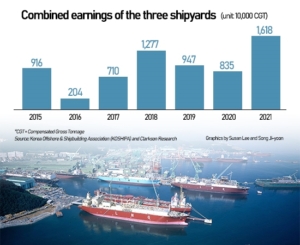

Korean shipyards focus on innovative ships with high margins. They took off dynamically in 2023 despite a general slowdown in the pace of new orders around the world. While China regained its lead in new orders in March, the Korean shipbuilding industry emphasizes that it maintained its leading position in the first quarter. This puts it on a path of sales growth in 2023 as Korean shipyards gain a competitive advantage by focusing on innovative, high-margin ships, Korea Shipbuilding & Offshore Engineering reports.

Republic of Korea’s shipyards focus on high-value-added ships. They took over 65% of contracts for gas carriers, including LNG carriers. They closed 2022 with orders for 10.12 million CGT. For comparison, orders for container ships amounted to 4.26 million CGT. Chinese shipbuilders won 6.76 million CGT of contracts for container ships, 4.4 million CGT for LNG carriers and 3.32 million CGT for bulk carriers.

Bancosta experts note that previous deliveries of LNG tankers reached a record supply in 2018, when 51 units with a capacity of 8.30 million m3 left the yard. In the case of LPG tankers, the highest level of deliveries was achieved in 2016, when operators launched a total of 93 vessels with a capacity of 4.70 million m3. In 2022, 61 LPG carriers (2.74 million m3) entered the oceans.

“Business Korea” reported in early April that the three major players in Korea Shipbuilding & Offshore Engineering (KSOE) holding company Hyundai, Samsung Heavy Industries and Daewoo Shipbuilding & Marine Engineering (DMSE) secured a third of its annual target orders in the first quarter of 2023.

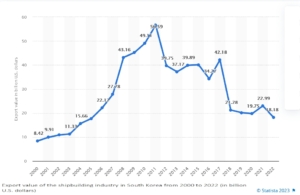

Thanks to the increase in prices for new ships caused by the increase in demand, orders obtained by KSOE shipyards have reached a value of approximately USD 10.5 billion – experts from “Business Korea” estimated and forecast that the holding’s shipyards will achieve sales of USD 32 billion in 2023. Forecasts are based on the fact that in the first quarter of this year KSOE shipyards obtained order backlog worth USD 7.3 billion.

More: Korean shipyards GospodarkaMorska.pl