Expensive Gigawatts of Offshore Wind Energy. Time to review the risks and economic analysis of the investment

By Marek Grzybowski

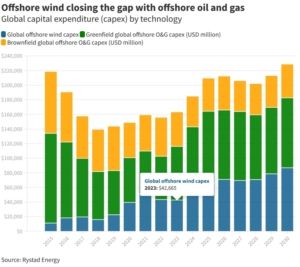

European ambitions for the development of offshore wind energy will adjust the market in 2023 and 2024. With an estimated cost of about USD 3 billion per 1 GW of installed offshore wind capacity in mid-2022, ambitious investment goals in offshore wind farms and business plans will have to be adjusted. In 2023 and 2024, these investments will be driven by inflation, rising component prices and expensive workforce.

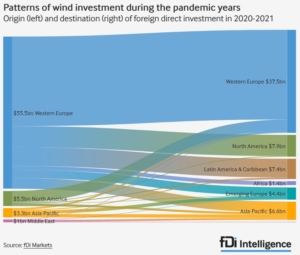

The push by European countries to reconcile their net-zero emissions ambition with the need to address growing energy security concerns following the Russian invasion of Ukraine has created an unprecedented momentum for capital-intensive offshore wind development across Europe, writes Jiyeong Go, fDi Intelligence.

In the first half By 2022, the global capacity of offshore wind energy increased by a total of 6.8 GW, according to the semi-annual report of the World Forum Offshore Wind (WFO) and calculates: “out of 33 new offshore wind farms, 25 were built in China, in Vietnam (5) , UK (1), South Korea (1) and Italy (1). By the end of 2022, installed capacity could double thanks to investments in excess of $41 billion.

The prices of all product categories and labor and service have increased significantly over the last six months and will increase over the next two years. There is still no specific information on the involvement of Polish producers in investments. Certainly neither installation nor service ships were ordered from Poland. It can therefore be expected that wind turbine installations will be carried out on the basis of fleets of operators from outside Poland. It can also be assumed that neither turbines nor rotor blades will come from Polish factories.

Will Europe and Poland cope with the rising costs of wind farm components as well as logistics and service? It is worth taking up this topic before we notice with surprise that the project will turn out to be very expensive and unprofitable.

Already today, we have to count the costs, which have started to grow in virtually all significant segments of OWE. It is worth making a solid risk analysis as soon as possible and conducting an economic analysis taking into account the conditions for the implementation of OWE in 2023 and in the following years.

The experience gained during the implementation of the investment in this year will be invaluable when concluding contracts for subsequent installations and assessing ROI.

More: Costly Gigawatts of Offshore Wind Energy