Wartime Oil Markets. Sea transport needs VLCC and product carriers

By Marek Grzybowski

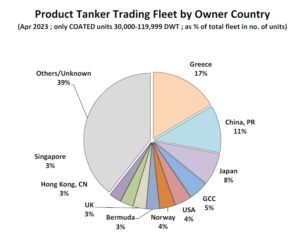

The beginning of 2023 is a good time for oil trading, despite its high prices and the growing risk of economic recession. According to Refinitiv data, in the period from January to April 2023, the supply of crude oil in sea trade increased by 9.4%, to 717.8 million tonnes. The main beneficiaries were operators from Greece, who own 28% of the tanker fleet and 17% of the world’s product carrier fleet.

The Energy Information Administration predicts in its latest report that global oil demand will increase by 2 million barrels a day in 2023, reaching a record level of 101.9 million barrels. In addition, this year we will be able to observe deepening disproportions between regions in terms of demand. Its growth on the global market will most likely be driven mainly by non-OECD countries and the recovering economy of China. These markets will generate up to 90% of the growth.

Demand in OECD countries has been slowed down by weak industrial activity and the fight against global warming. For this reason, the market shrank by 390 thousand barrels per day in the first quarter of 2023. This is the second consecutive quarter of falling demand. Kerosene is responsible for 57% of profits this year. fuel trading companies. In turn, Banchero Costa Research informs that the sea transport of crude oil in the first quarter of this year. surpassed the increase from previous periods, when from January to April an increase of 656 million tons was recorded. In the same period in 2021, it was 612.7 million tonnes, while in 2020 it was over 716.6 million tonnes.

Demand for tankers and product carriers

The decrease in demand also affected the market of large tankers and product carriers. In the first quarter of this year the situation has changed favorably for the operators of both groups of tankers. In the first four months of 2023, imports to China rose sharply by 12.3% to 161.4 million tonnes. This was more than the record 159.6 million tonnes for the same period in 2020. This is about 81% of the volume unloaded in the fuel terminals of China’s seaports last year. Oil was delivered mainly by VLCC tankers. Up to 7% of the crude oil reached the ports of China by Suezmax ships, and about 11% arrived in the tanks of Aframax ships.

Main crude oil import terminals in China

Banchero Costa Research analysts determined that the main crude oil import terminals in China are: Ningbo/Zhoushan (65.8 million tons in 2022), Qingdao (41.4 million), Lanshan (42.1 million), Dalian (38, 3 million), Zhanjiang (29.1 million), Dongjiakou (29.8 million), Quanzhou (22.5 million), Huizhou (24.3 million), Tianjin (23.2 million), Yantai (20.1 million ), Beilun (16.4 million), Caofeidian (13.9 million), Shuidong (13.1 million), Cezi (12.2 million), Yangpu (9.6 million), Bayuquan (7.6 million), Fangcheng (2.3 million).

The main suppliers of crude oil to China are the countries of the Middle East. Saudi Arabia is the largest exporter, providing 18% of the volume in 2022 and it was 79 million tonnes. In the same period, imports from Iraq to China increased by 2.8% to 51.2 million tonnes, and from the United Arab Emirates by 27.4% to 34.1 million tonnes. China imported 0.8% more crude oil from Oman than a year earlier (35.9 million tonnes), while imports from Kuwait amounted to 29 million tonnes. From Russia, imports of crude oil by sea increased by 30.7% to 42.2 million tonnes in 2022. Russia accounts for less than 10% of China’s total imports. Imports from West Africa decreased by 18.2% to 47 million tonnes in 2022, and imports from the North Sea decreased by 56.2% to 8 million tonnes.

Russian oil exports are on the rise

Oil exports from Russia increased in March this year. not only to China. It reached its highest level since April 2020, thanks to the growing supply also from India. Exports of refined products to EU countries grew dynamically from the refineries of this country. In this way, both Russia and EU producers circumvent the sanctions introduced by the EU Commission.

Russia’s supply to the international market has returned to the levels seen before Russia’s invasion of Ukraine. Total oil shipments increased by 600,000 tons. barrels to 8.1 million, while the supply of refining products increased by 450 thousand to 3.1 million. Russia’s estimated revenue from oil exports increased by $1 billion to $12.7 billion, but was 43% lower than a year earlier. American EIA experts calculated that global oil inventories remained at a stable level in February after an increase of 58 million barrels in the previous month. Non-OECD oil inventories fell by 11.5 million and 2.1 million respectively, while total OECD inventories rose by 8.8 million. OECD trade inventories increased by 9.6 million, reducing the deficit from the five-year average to 7.5 million. Preliminary figures for the US, Europe and Japan show a massive 38.9 million drop in inventories in March.

More: Wartime Oil Markets GospodarkaMorska.pl