The Asian shipbuilding industry is going full speed ahead

By Marek Grzybowski

By Marek Grzybowski

The shipbuilding industry is booming and shipowners are fighting for places on the docks. Unfortunately, but in Asian shipyards. European shipyards save themselves by orders for passenger ships, specialized ships and ships. Companies from the shipyard’s environment save themselves by selling the latest equipment and technologies to Asian shipyards.

– Demand for innovative ships is growing and it looks like the reopening of decommissioned shipyards, especially in China – announces Mohamed Rabie of SnP Broker Intermodal in the latest report.

Prices of ordered ships and on the secondary market remain high. Prices for new LNG carriers in June 2023 were around USD 218 million. Indicative prices for 5-year-old used LNG tankers in June 2023 were estimated at USD 200 million, Banchero Costa reports. This is important information for Poland, because we are planning to build an FSRU terminal in Gdańsk. And some terminals are built on the basis of modernized units purchased on the secondary market.

For comparison, Newcastlemax bulk carriers in June 2023 were contracted for approximately USD 66.5 million, and USD 60 million for the Standard Capesize. In June 2023, 5-year-old Newcastlemax ships cost USD 50 million, and Standard Capesize around USD 46.3 million.

High prices for new and used ships

In June this year, the shipyards demanded about USD 130 million for the VLCC vessel, USD 83 million for the Suezmax and USD 67.1 million for the Aframax for the new oil tankers. For the 5-year-old tanker, prices in June 2023 were estimated at around USD 97.6 million for VLCC, USD 69.2 million for Suezmax and around USD 64.2 million for Aframax.

Product prices remained stable. For example, in June this year, the MR2 tanker was contracted for approximately USD 46.6 million. On the other hand, the 5-year-old MR2 ship was offered in June 2023 for approximately USD 42.5 million, according to Banchero Costa experts in the latest reports.

– During the first 6 months of 2023, a total of 719 ships were contracted, of which 24.2% were bulk carriers, 23.09% were tankers (oil and products), 9.46% were containers, 5.01% were LPG tankers, and 4.31% LNG carriers, according to the latest Intermodal report.

The shipyard’s production capacity is increasing

– The shipyard’s production capacity is expected to be increased by 1.5 million CGT after the reopening of 12 shipyards in China. Thus, the 299 active shipyards in 2023 represent a total production capacity of 54 million CGT, believes Chara Georgousi.

Utilization of the 80 leading Asian shipyards is projected to increase to 83% in 2023 from 65% in 2022, while in 2024 it could increase to 91%. According to her, “Leading shipyards in South Korea and China are ahead of shipyards in Japan and other countries.”

The procurement structure for environmentally friendly ships is also changing. The number of units ordered with dual-fuel engines is increasing, the number of orders for power plants with scrubbers (washers) is decreasing. This is good news for European manufacturers of innovative engines, scrubbers and ship propulsion systems powered by batteries or LNG.

– In the first five months of 2023, 20% of the ordered ships will be able to use alternative fuels – says Antonis Tsimplakis – columnist for “Naftemporiki”. 6% of them will be fueled with gas from LNG tanks, 9% with methanol, and only 5% with LPG.

Alternative fuel course

Market analysis conducted by Intermodal shows that from 2022, most new ships ordered are equipped with some kind of emission reduction technology or with “off-the-shelf” technologies for the use of alternative fuels. According to Intermodal, this trend will continue in the coming years.

Today, in the case of the active fleet, approximately 0.54% of ships use alternative fuels, while in the shipyard order book the percentage that will use alternative fuels reaches 14.69%.

– Currently, 911 ships use LNG as fuel, 182 ships use LPG, 127 ships use methanol and only 27 ships use hydrogen. Of the current order backlog, 10.31% of ships will be powered by LNG, 2.03% by methanol, 1.91% by LPG and just 0.42% by hydrogen, according to Tsimplakis.

China is the leader – orders increased by 67.7%

Published by the China Association of the National Shipbuilding Industry (CANSI) Statistics after the first half of this year. reported that there was an increase in the number of new contracts in Chinese shipyards by 67.7%. Among them, export orders account for 92.8% of contracts.

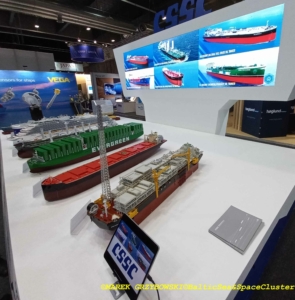

Orders for the construction of new ships rose sharply this year. Container ships and LNG carriers still dominate the docks of Chinese shipyards. More oil and product tanker contracts have emerged.

– In the first half of the year, Chinese shipyard workers delivered ships with a carrying capacity of 21.13 million tons, which means an increase of 14.2% year on year – reports CANSI.

In the first six months, China’s shipbuilding output accounted for 49.6% of world output. However, the portfolio for new orders for shipbuilding accounted for 72.6% of global contracts, which corresponded to 53.2% of the deadweight capacity in the global market.

Korea’s shipyards with high profitability

Korean shipyards are trying to keep up with China. Excellent contracting results were achieved already at the beginning of 2023

Three holding companies: Korea Shipbuilding & Offshore Engineering (KSOE), Daewoo Shipbuilding & Marine Engineering (DSME) and Samsung Heavy Industries – from the beginning of 2023, taking advantage of the economic situation, collected orders for ships with high added value. In just two months, the value of orders exceeded 10 trillion won ($8.6 billion), Business Korea reported.

Although global ship orders fell earlier this year due to the economic downturn, Korean shipbuilders followed a strategy of selective procurement. Environmentally friendly vessels with high added value, such as LNG carriers, are contracted. This strategy has paid off handsomely, analysts say.

Contract Selection Policy

Korea’s leading shipbuilders secured ship orders totaling USD 8.59 billion (approximately 10.87 trillion won) at the beginning of the year. It was assumed that in the first half the value of the contract portfolio will double, and by the end of 2023 the value of orders for ships will increase to approximately USD 32 billion).

The contract selection policy brings results. KSOE, which ended 2022 with a loss of 35.56 billion won ($27.43 million), is expected to make a profit of nearly 1 trillion won ($771 million) this year, according to sources from Korean financial institutions.

The shipbuilding industry in Asia is capturing windfall profits from the turmoil in the global oil, gas and product shipping market. Supported by his governments, he marginalizes shipbuilding in Europe.

European governments support companies from the vicinity of shipyards with billions of euros and crowns in the development of innovative technologies. These, in turn, are transferred to Asian shipyards, which enter the maritime transport market, encased in ship hulls built in China and the Republic of Korea.