Container record holders. Ports under the pressure of innovation in maritime transport

By Marek Grzybowski

By Marek Grzybowski

About 6,700 container ships with a carrying capacity of about 330 million tons and a capacity of about 27.6 million TEU at a time pose a challenge for ports. Almost 70 years have passed since the first container ship entered the port.

When the ship converted by Malcolm McLean set sail in 1956, cargo managers, forwarders, shipowners and operators transporting general cargo approached the new type of cargo transport system with reserve. Port workers also approached the new technology with a distance.

For almost 70 years, the race has been going on for the most economically efficient container ships and adequately efficient terminals capable of handling them.

Ports and innovative ships

Up to the pace of construction of new ships, ports are trying to adapt. Also Polish. The decision to build a container port in Świnoujście, an external port in Gdynia and another quay in the Baltic Hub in Gdańsk are timely actions, in line with the trend of introducing larger and larger ocean vessels and feeders.

Despite another reduction in freight on liner connections, shipowners have not slowed down and continue to invest in expanding their container fleets. For ports and companies servicing new vessels, the challenge is not only their size and the need to adapt quays and cranes to mega container ships.

Operators are investing in multi-fuel vessels with reduced crew numbers. Safety during bunkering and operation of giant container ships with different fuel systems is a task not only for bunker or tanker operators. It is also a challenge for port authorities and maritime administrations to ensure safe bunkering procedures and processes.

Currently, there are seven basic types of container ships in operation. The smallest are the feeder ships: Small Feeder, Feeder, Feedermax. Then there are ocean vessels: Panamax, Post Panamax, New Panamax (or Neo Panamax) and Ultra Large Container Vessel (ULCV).

Record-breaking container order portfolio

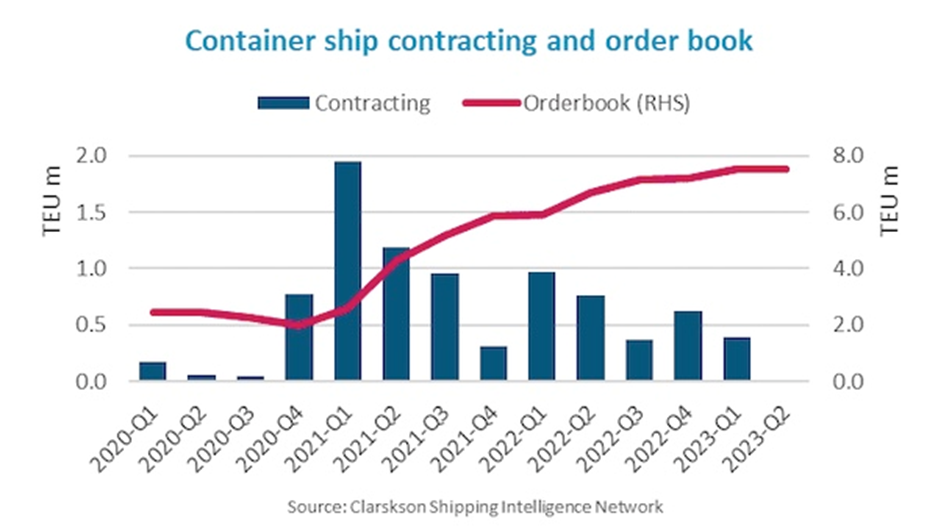

In the last 10 quarters, 8.61 million TEUs were contracted, which corresponds to the capacity of ships contracted in the previous 30 quarters. The order backlog has been growing for ten quarters in a row, reaching new records in each of the last four quarters, and at the level of 7.54 million TEU, it now represents 28.9% of the existing fleet.

– Despite the collapse of freight rates, shipowners still have an appetite for new orders for container ships, and the order book is constantly growing. The record high order backlog of 7.54 million TEU will result in significant changes to the container fleet in the coming years, emphasized Niels Rasmussen, Copenhagen-based chief shipping analyst at BIMCO.

Operators with record ship orders

Alphaliner data shows that leading shipowners invest heavily in innovative and increasingly larger vessels. MSC, which manages a fleet of 773 ships (including 475 own, the rest in charter) with a capacity of 5,210 thousand tons. TEU (2,732.6 thousand TEU) ordered 126 ships with a capacity of 1,551.5 thousand. TEUs. This means the expansion of the fleet by about 30% of its own stock.

The CMA CGM Group with a fleet of 629 ships (3,512,000 TEU), including 242 own vessels with a capacity of approximately 2.5 million TEU, contracted mainly in Korean and Chinese shipyards for 117 ships with a capacity of over 1.2 million TEU, which is 34 5% of own fleet in operation.

One of the record holders in the family of container ship fleet operators is Evergreen Line. The shipowner has a portfolio of orders corresponding to over 50% of the operated fleet. The operator manages a fleet of 213 vessels with a capacity of 1,673.6 thousand tons. TEU, of which 126 own units with a capacity of approximately 952.2 thousand. TEUs.

Over 5 million TEUs by 2024

Larger ships are not the only revolution, and actually not a revelation in container ships. Shipowners have adopted various decarbonisation strategies. And this is a challenge not only for shipyards. Design offices and shipbuilders from Asia quickly mastered the production and assembly technologies of new types of power plants.

Ship deliveries will also increase the demand for different types of fuels. BIMCO experts have calculated that 57% of the TEU capacity in the order book includes ships with power plants prepared to use alternative fuels.

90% of the fleet of 6,700 ships currently has engines adapted to burn traditional marine fuel. The first methanol container ships and the first ships with engines adapted to ammonia have already been delivered.

A large order book

– A large order backlog will result in a significant increase in the fleet. Planned deliveries for 2024 and the rest of 2023 currently amount to 5.03 million TEU. We estimate that recycling will be close to 1 million TEU during this period, so the fleet could soon exceed 30 million TEU for the first time. This means an increase of 16%, predicts Rasmussen.

The Port Authority of Singapore has announced that Maersk and Hong Lam Marine have successfully completed the world’s first methanol bunkering operation for a Maersk container ship at Raffles Reserved Anchorage.

5 fuels for container ships

According to the shipowners’ announcements, five different fuels will be used: low- and high-sulphur marine fuels and LNG, and more and more commonly methanol and ammonia.

“As the use of alternative fuels increases, it will become increasingly difficult to establish a single appropriate benchmark for the time charter and asset markets,” Rasmussen believes.

The analysis of the order portfolio allows us to conclude that the share of the operators’ own fleet will continue to grow. Ten years ago, the operators’ own fleet accounted for 50% of the container ships in operation.

BIMCO estimates that it is currently around 61%. Shipowners focus not only on the modernization and introduction of larger and larger ships, but also on increasing their own market shares.

The implementation of this year’s contracts means that this share will continue to grow in the coming years.

Leading shipowners – the main investors

Currently, the main investors in the new tonnage are leading shipowners, who already own 65% of the portfolio of orders placed in shipyards, mainly Chinese and Korean.

It has become a rule that the owners of the largest ships operate on the basis of long-term charter contracts, and smaller container ships dominate the short-term charter market.

This is important for the entire maritime logistics market, including container terminals. Combined with increasing ownership share, operators’ ability to use the time charter market to quickly adapt fleet capacity to demand for cargo space is diminishing.