Offshore wind energy in Europe catches the wind in the propellers

By Marek Grzybowski

By Marek Grzybowski

Installations have been built that will provide another 2.1 GW of new offshore wind energy in waters around European countries in the first half of 2023. Investments in offshore wind energy are returning to normal, but there is still some catching up to do, including in the potential and organization of the supply chain, WindEurope informs in the latest report. Therefore, there are chances for Polish producers to supplement the production capacity for the dynamically developing industry.

The WindEurope report comes a month after the 114th and final wind turbine was installed at Seagreen. It is the last wind turbine on Scotland’s largest offshore wind farm. Seagreen Wind Farm is a joint venture between SSE Renewables and TotalEnergies. 76 of the 114 Vestas V164-10.0 MW turbines are now powered in the basin, which is 27 km off the coast of Angus. The wind farm has not yet reached full capacity. Seagreen will be able to generate about 5 thousand. GWh of renewable energy per year for consumers in over 1.6 million homes.

Supply chain needs new investments

After delays in investment activity that occurred last year, many companies that obtained concessions for the construction of OWF made final investment decisions regarding the commencement of further installations. They are to provide a capacity of around 5 GW by the end of 2023. This is not a satisfactory pace. The supply chain and logistics of offshore wind energy still require modifications and improvements.

“The entire supply chain urgently needs new investments – and the EU Net-Zero Industry Act does not provide conditions for the development of OWE in its current form. The auction design is another red light: Governments must allow cost indexation and avoid unrestricted negative bidding.

The European Union is an attractive FOW market

The countries of the European Union dominate the pace in offshore wind energy installations and the development of floating installations.

According to the latest TGS/4C Floating Offshore Wind Report, Great Britain is still the most attractive market for the development of OWE based on floating installations.

The next prospective markets are Norway and South Korea. The following places were taken by the United States, Japan, France, Spain, Italy and Portugal.

Increase the pace in floating MEWs

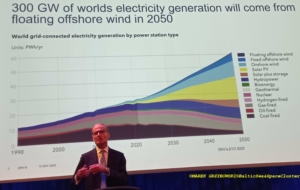

“This was the reason why today we had to deal with major shifts in the investment processes. It is to be more dynamic after 2030. Instead of the forecasted 12.4 GW of power from floating wind farms by 2030, it is expected that we will obtain from 6 to 7 GW in EU waters.

On the other hand, the planned offshore wind farms will be in various stages of construction,” predicts the TGS/4C Offshore pessimistically in the Floating Offshore Wind Report.

The production potential of floating wind farms will increase to 39 GW by 2035. The projected values are respectively lower by 1.8 GW and 6.4 GW compared to the Q4 2022 analysis and by 3.7 GW and 8.7 GW in compared to Q2 2022 – explains the revision of the TGS/4C Offshore forecasts.

“This is below what is needed to meet Europe’s energy and climate targets,” OWF market WindEurope assesses, explaining that “Investments have been delayed in 2022 due to regulatory uncertainty caused by sudden government interventions in energy markets. So Europe has a lot of catching up to do.”

Production investment required

Countries in Europe will need to expand their offshore wind product supply chain to ensure component supplies are in line with projected growth. Investments are necessary in the production of components for wind farms, but also in workforce and infrastructure. According to WindEurope, progress in these areas is too slow.

And this is an opportunity for Polish companies that seriously intend to enter the market of stationary and floating offshore wind farms.

This is not only an opportunity to enter a new industry, but also to ensure contact with an industry focused on technical and organizational innovations, using the latest material and IT technologies, transferring knowledge from the chemical and space industries, using big data and digital twins on a large scale, AI systems and VR, 3D printers.

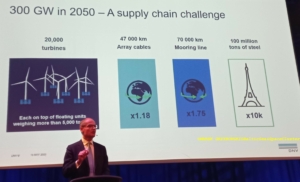

The scale of OWE needs was discussed at the Floating Wind Days 2023 conference in Haugesund by Ditlev Engel, DNV’s general director for offshore energy. To achieve the goal of 300 GW from floating wind farms in 2050, 20,000 will be needed. turbines. Derived demand will generate demand for 47,000 sq m. m of cables, 70 thousand. steel moorings and 100 million tons of steel, Engel calculated.

OWE bottlenecks – EU needs to put money on the table

– There are already bottlenecks in the production of foundations for offshore wind turbines and in the availability of installation vessels. New turbine and cable factories are also needed. To this must be added EUR 9 billion of investment in port infrastructure. And large investments in new network connections – WindEurope experts enumerate.

Europe needs to change its regulations (e.g. on licensing and market design) to justify the business case for such investments. Social support will also be needed. The EU programs and regulations of the Green Deal Industrial Plan and the Net-Zero Industry Act in their current form do not meet the demands of facilitating the development of offshore wind energy.

“The EU needs to put money on the table to help scale up the supply chain – not just finance innovation. National governments must make the most of the new flexibility that EU state aid rules bring to support investment. And the auction rules must reward investments in supplier resilience and other added value areas.

EU supports all initiatives in the field of renewable energy

Ricardo Renedo Williams, Policy Officer, Infrastructure and Regional Cooperation, DG ENERGY, said at a meeting with representatives of the European Network of Maritime Clusters that the EU supports all initiatives in the field of renewable energy, including offshore wind energy. We wrote more about this on GospodarkaMorska.pl and www.bssc.pl .

The European Green Deal has placed renewable energy at the heart of the clean energy transition. The current international tensions after the Russian invasion of Ukraine, the general geopolitical context and very high energy prices have exacerbated the need to accelerate energy efficiency and the spread of renewable energy in the Union in order to gradually eliminate the EU’s dependence on Russian fossil fuels.

Ricardo Renedo Williams informed about the new European Commission document Proposal for Council Regulation establishing a framework for accelerating the deployment of renewable energy (COM/2022/591 final), published on 9 November 2022.

New criteria and rules for conducting auctions

Governments must improve the criteria and rules for auctioning new installations. Auction prices need to be indexed to cover the difference between the auction bid price and the actual installation cost. “The cost of offshore wind turbines has increased by up to 40% in the last two years. If governments do not recognize this, they will lose projects, just as the UK lost Vattenfall’s Boreas offshore wind project”.

Governments must not be tempted by “unlimited negative bidding” – requiring developers to pay whatever they can for the privilege of building an offshore wind farm. Out of the 12 GW of offshore wind farms awarded in shares so far this year, 60% were awarded as part of an unlimited negative offer – criticizes WindEurope.

UK auctions create the OWF market

For example, the UK government auction conducted last year enabled access to contracts for a record 11 GW. On the offered reservoirs, producers will generate electricity much cheaper than current gas prices, according to experts from the UK government.

Projects from last year’s auctions are to start supplying electricity within the next five years. In the middle of last year an average price of £48 per MWh was obtained. This is a ninth of the £446/MWh cost of obtaining energy from gas-fired power plants, according to CarbonBrief.org.

According to the British, in 2022 offshore wind energy was the cheapest and most significant technology for the energy sector. Contracts for 7 GW of new installations were obtained at auctions. According to them, the contracts will be delivered “at a record low price of £37/MWh in 2012 prices (£44/MWh in 2022 prices) – quotes CarbonBrief.org.

The amounts that developers offer in tenders in Germany currently reach over EUR 1.5 billion per GW.

Offshore Wind made in Norway

Jonas Gahr Støre, Norwegian Prime Minister and Arne Vatnøy, Communication Manager, Norwegian Offshore Wind, opening discussion, Floating Wind Days 2023 in Haugesund

Jonas Gahr Støre, Norwegian Prime Minister and Arne Vatnøy, Communication Manager, Norwegian Offshore Wind, opening discussion, Floating Wind Days 2023 in Haugesund

More and more countries are betting on floating wind farms. The participants of the Floating Wind Days 2023 in Haugesund, where the headquarters of Norwegian Offshore Wind, one of the leading clusters developing new technologies related to offshore wind energy, could find out for themselves.

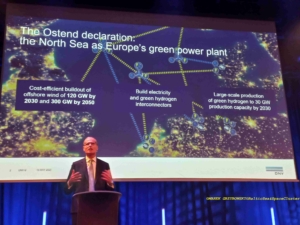

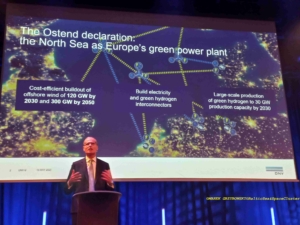

The goal of the Norwegian government is to reach 30 GW by 2040, announced the Norwegian Prime Minister Jonas Gahr Støre during the opening speech of the conference.

One of the newest offshore wind farms completed this year is the Hywind Tampen floating offshore wind farm in Norway. With a capacity of 88 MW, it is the world’s largest floating wind farm. Hywind Tampen is located approximately 140 km offshore, and the installations are located in water depths ranging from 260 m to 300 m.

The turbines are installed on a floating concrete structure with a combined mooring system. The project was financed by Enova NOK 2.3 billion and NOK 566 million by NoX.

France – over EUR 2 billion from the EU for the construction of FOW farm

France has dedicated waters off the coast of southern Brittany to a floating wind farm. It is forecast that it will be possible to build installations with a capacity of 250 MW to 270 MW.

At the beginning of this year The European Commission has approved, under EU state aid rules, €2.08 billion to support the construction and operation of a floating offshore wind farm in France.

Areas for floating wind farms have also been designated in Great Britain and southern Europe, including Portugal.

Wood Mackenzie: Billions for producers and logisticians

“The global offshore wind supply chain will require a $27 billion investment in production and logistics by 2026 if it is to cope with a five-fold increase in installations per year (excluding China) by 2030.” – inform Wood Mackenzie experts in the August report “Cross currents: Charting a sustainable course for offshore winds”.

“The amount was calculated based on the forecast of Wood Mackenzie analysts, which assumes an increase in capacity by 30 GW by 2030. The increase in capacity is slowed down by the decisions of decision-makers [read: governments – Ministry of Economy] in the field of offshore wind energy development. [achievement of the planned goals – MG] requires the installation of almost 80 GW per year on a global scale and over 100 billion dollars of investment” – writes Adnan Memija, publisher of offshoreWIND.biz.

– Almost 80 GW of installations per year would be needed to meet all government targets. It’s not realistic. Even meeting our projections of 30 GW of additional capacity will prove unrealistic unless there are immediate investments in the supply chain,” said Chris Seiple, vice president of energy and renewables at Wood Mackenzie, co-author of the report.

The time has come for bold decisions

Renewable energy, including offshore wind farms, can effectively replace fossil fuels. However, there is a new barrier to overcome. Supply barrier. The capacities of existing producers are too small or there are no final investors nearby.

And here is an opportunity for those producers who want to seriously enter the offshore wind energy market, including the rapidly growing market of floating farms. In Poland, business was initiated by, among others, Crist, introducing innovative installation units to the market.

Will others follow in the footsteps of the Gdynia-based company? Reports show that the demand for various types of products for offshore wind energy will grow. The time has come for bold decisions and investments in production.

Photos from the Floating Wind Days 2023 conference in Haugesund and ENMC meeting: Marek Grzybowski