Demand for alternative fuels is growing in ports

By Marek Grzybowski

By Marek Grzybowski

Lower LNG prices resulted in greater demand for gas in ports. In Rotterdam, LNG sales increased by almost 109% quarter on quarter, reaching 266,000 in the second quarter. m³. In Singapore, shipowners bunkered 17.9 thousand tons in June. m³, and in July 18.3 thousand. m³ LNG. It is predicted that there will also be demand for methanol, which may become the fuel of the future.

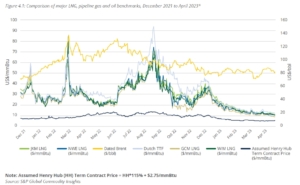

Russia’s invasion of Ukraine has disrupted global LNG markets and pushed LNG prices to above $2,500 per tonne in Rotterdam and above $2,000 per bunker tonne in Singapore last year. However, since then prices have dropped significantly and for several months LNG has been available at large discounts. Gas on ships has again become more attractive than VLSFO, which was quickly noticed in the world’s main ports, where bunker turnover reaches significant volumes.

In Rotterdam, LNG sales amounted to 112,069 m³ in the second quarter of 2022. LNG sales in the second quarter were also the highest quarterly sales volume since the third quarter of 2021 (212,719 m³). In the first half of 2023, LNG sales amounted to 265,892 m³. For comparison, in the corresponding period of 2022, 214,648 m³ were refueled. Ship operators or ship management companies were concerned about price volatility and the possibility of using regular gas supplies.

Economic situation and bunker prices

Information about the demand for a bunker is also information about the activity of economies and the ports that depend on them. According to new data from the Port of Rotterdam Authority, the total sales volume of bunker in Rotterdam (excluding lubricants) decreased by 10% in the second quarter of 2023. This was due to low VLSFO sales.

Demand dropped in the second quarter of this year. by 8% to 906,368 tons, i.e. a level 15% lower than in the previous year. In the second quarter, traditional marine fuels still constituted the majority of demand, as their share reached 38% of total sales. In turn, HSFO sales increased by 5% in the second quarter, and the share of this fuel in sales increased from 30% to 35%. Total sales volume also increased during the year, reaching an 18% increase compared to 2021 levels.

The increase in HSFO sales occurred despite increasingly uncompetitive prices of this type of fuel compared to VLSFO in the second quarter. Declining oil availability has resulted in reduced production of high-sulfur fuels at refineries, pushing prices above seven-month highs in mid-April.

Dual-fuel (LNG) ships have an economic justification

– The return of Kairos increases Gasum’s ability to serve marine LNG and Bio-LNG customers as effectively as possible – the operator said. The Kairos tanker has a tank capacity of 7,500 m³ and is equipped with a dual-fuel engine using LNG as the main fuel. It has a number of technical solutions that allow it to service ships with LNG systems and LNG terminals.

It is assumed that the biogas offered by Gasum will reduce carbon dioxide emissions by an average of 90 percent compared to traditional fossil fuels.

– Increasing the use of bio-LNG is one of the specific actions that will lead the shipping industry towards a low-emission future – emphasized the company.

– Gasum’s strategic goal is to bring to market seven terawatt hours (7 TWh) of renewable gas per year by 2027. Achieving this goal would mean an annual cumulative reduction of carbon dioxide emissions for Gasum customers by 1.8 million tonnes, the company says.

This summer the operator carried out the first LNG bunkering operation in the port of Reykjavik in Iceland. LNG bunker Coral Energy delivered LNG and liquefied biogas (LBG) to the power plant of the PONANT Le Commandant Charcot cruise ship.This year, for the first time, owners of dual-fuel LNG ships have an economic justification to benefit from investing in innovative power systems for new types of ship engines.

However, because the price of LNG was too high for most of the 21st century, the vast majority of dual-fuel ship operators used traditional ship fuel.

As soon as gas became cheaper, it was also profitable to introduce the bunker to the market. In June, the Kairos tanker returned to service under Gasum. This is an LNG bunkering vessel owned by Gasum. From October 2022, the shipowner intended it to be used on the free market outside the company.