Union on liquid gas. Seaborne LNG imports to the European Union are growing, prices are falling

By Marek Grzybowski

By Marek Grzybowski

The energy security of the European Union is increasing thanks to the dynamic growth of LNG exports from the United States. Global seaborne LNG trade continued to grow last year, driven largely by shifting supply chains following Russia’s invasion of Ukraine. LNG prices have dropped dramatically this year.

The lack of supplies via pipelines through the Baltic Sea and land infrastructure, sanctions imposed on Russia by the European Union and the withdrawal of gas supplies from Russian deposits forced Europe to diversify its gas supplies.

In 2022, global LNG carrier deliveries rose 4.9% y/y to 404.1 million tonnes, according to ship tracking data from Marine Refinitiv.

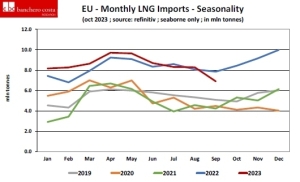

This year, deliveries increased dynamically in the first quarter, but maritime LNG transport slowed down in spring and summer. In the first 9 months of 2023, LNG deliveries increased by 1.6% y/y to 304.2 million tonnes, says Banchero Costa in the latest report.

Last year 299.6 million tons were delivered to LNG port terminals. the dominant LNG exporter is currently the United States, which accounted for 21.2% of deliveries in the first 9 months of 2023. The next players on the supplier market are Australia with 19.8% and Qatar with 19.6% share.

The USA is the leader in LNG exports

The USA exported 64.5 million tons of liquefied gas in the period January-September 2023, recording an increase in supply by 7.9% y/y. Australia exported 60.2 million tonnes during 9 months of this year. and it was the same volume as last year. Qatar exported 59.7 million tons in January-September 2023, +0.7% y/y.

Russia directed 21.9 million tons of fossil gas to the international market at the same time this year. And this means a decrease of 9.5% y/y compared to the same period in 2022. This is still more than in 2021.

Mainland China imported 50.9 million tons of LNG in the period January–September 2023. This was an increase of 10.8% y/y. Because in the period January – September 2022, imports amounted to 46 million tons. Import this year however, it did not reach the volume from 9 months of 2021, when PRC gas terminals received 59.1 million tons of liquefied gas from LNG tankers.

The European Union is the leader in LNG imports

The European Union (27) is currently the world’s largest importer of LNG. Countries on the European continent have recorded the greatest increase in demand over the last few years. In the period January-December 2022, the European Union imported 100.8 million tons of LNG, which means an increase of 68.9% y/y. Because a year earlier, only 59.7 million tons of LNG were delivered to Europe by LNG tankers.

In the first 9 months of 2023, the EU imported 76.5 million tons of LNG, which is 4.4% more than in the same period last year. European Union countries currently account for 25.3% of global LNG imports by sea.

China was in second place with a share of 16.9%, and Japan was in third place with imports of 16.3% of global demand in the period January-September 2023 – calculated experts from Banchero Costa.

This year Within 9 months, the largest recipient was France, which received 26.4 million tons of LNG at LNG terminals. Next was Spain with 22.8 million tonnes. The next major importers of LNG are: the Netherlands (12.8 million tonnes) and Belgium (11.3 million tonnes). 10.7 million tons were delivered to Italy, 4.5 million tons to Portugal and 4.4 million tons to Poland.

Poland without gas from Russia

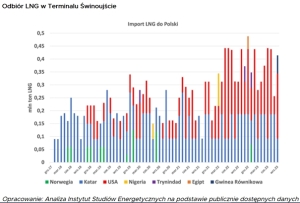

Orlen reported that “more than half of the gas that PGNiG from the Orlen Group imported from abroad in 2022 is LNG and supplies via gas pipelines from new directions – Norway and Lithuania.”

Nearly a quarter of all gas imports are imported via gas carriers from the United States. Russian gas supplies were suspended in April 2022. It was announced that “2023 will be the first full year without gas imports from Russia.”

– According to calculations by the Institute of Energy Studies (ISE), in the third quarter of 2023, PGNiG Orlen Group received 15 LNG shipments at the terminal in Świnoujście, with a total volume of approximately 1.04 million tons of LNG (approximately 1.43 billion m3).

This means that for 9 months of 2023, PGNiG has already received 45 shipments at the terminal in Świnoujście with a total volume of approximately 3.20 million tons of LNG (approximately 4.42 billion m3) – writes Dr. Eng. in the commentary. Andrzej Sikora, President of the Management Board of the Institute of Energy Studies in “Polish LNG in the third quarter of 2023”, CIRE, 3/10/2023.

Great Britain is an importer of LNG

A significant increase in LNG imports was observed at UK terminals. In the period January-December 2022, LNG imports to the UK increased by 75.0% y/y to 19.4 million tonnes from 11.1 million tonnes in 2021.

In the period January-September 2023, the UK imported 11.7 million tonnes of LNG. It was 14.1% less y/y, because in the corresponding period of 2022, 13.6 million tons of imported LNG were transhipped.

For comparison, in the period January-September 2021, more than 7.9 million tons of LNG were imported to the islands by sea. The UK currently has only a 3.9% share of the global LNG import market.

LNG does not only flow across the Atlantic

The United States has become the main supplier of LNG to Europe. Recently, there has been a huge jump in delivery volumes from American LNG terminals. In the first 9 months of 2022, the EU imported 33.5 million tonnes of LNG from the US.

This means that 5.4% more LNG was transported across the Atlantic in tanks. US LNG imports amounted to 31.7 million tonnes in January-September 2022 and 11.7 million tonnes in January-September 2021. The United States provided 43.7% of marine LNG to Europe in the first three quarters of 2023.

LNG flows to Europe from Russia

LNG also flows to Europe from Russia, despite many efforts to implement sanctions and limit imports of liquefied gas from Russia. In the period January-September 2023, the EU imported 11.7 million tonnes of LNG from Russia.

This represents a decline of only 3.2% y/y compared to 12.1 million tonnes in the same period in 2022. This is still well above the 8.3 million tonnes imported in January-September 2021 and the 9.7 million tonnes imported in the period January-September 2020. During the first 9 months of 2023, Russia provided 15.3% of LNG supplies to the EU – emphasize Banchero Costa experts.

Qatar is currently in third place among the leading suppliers to the EU with a share of 12.7%. 9.7 million tonnes reached the EU from the Persian Gulf between January and September 2023. This means an increase of only 1% compared to the same period last year. West Africa provided 10.7% of LNG supplies to the EU. European terminals transhipped 8.2 million tonnes from this region. It was 5.4% less year-on-year.

It should be emphasized that in 2023 we saw record declines in natural gas prices. On November 10, gas prices from Henry Hub USA reached USD 3.03/mmbtu and were 52.6% lower than a year ago. LNG TTF Netherlands prices reached USD 14.60/mmbtu and were 58.7% lower than last year. Meanwhile, North East Asia LNG prices dropped by 58.7% to USD 16.50/mmbtu. And this is optimistic news for LNG importers.