US offshore wind farms domino for USD 250 million

By Marek Grzybowski

By Marek Grzybowski

It was supposed to be so beautiful. The Biden-Harris Administration announced in late November 2023 the approval of the Empire Wind offshore wind project (“Empire Wind”). This was the sixth confirmation of the US government’s strategic program. The administration’s strategic goal is to launch 30 GW of offshore wind energy capacity by 2030.

Empire Wind US LLC has planned to build two offshore wind farms, known as Empire Wind 1 and Empire Wind 2.

The lease area is approximately 12 nautical miles south of Long Island, New York and approximately 16.9 nautical miles east of Long Branch, N.J.

In total, the projects included the installation of up to 147 wind turbines with a total capacity of 2,076 MW generated from wind. These estimates were provided by the Bureau of Ocean Energy Management, (BOEM).

The collapse occurred in the fall of 2023.

“We look forward to starting installation of Empire Wind I expected in 2025, continuing our relationship with Equinor and bp as a preferred supplier, and bidding on future projects.” We continue to pursue additional opportunities, including international projects for 2026 and beyond, said Eleni Beyko, senior vice president of Offshore Wind in Great Lakes, following the companies’ decisions to launch investment processes related to the construction of the Empire Wind 1 and Empire Wind 2 installations.

Companies that won concessions to invest in American wind energy have finally revealed their cards. bp’s renewables chief said in early November 2023 that the US offshore wind industry was “fundamentally broken” and bp and its partner Equinor (EQNR.OL) were exploring the possibility of massive $840 million projects off the coast New York – reports CNN.

A week earlier, bp wrote down $540 million and Equinor took a $300 million write-down on the Empire and Beacon offshore wind projects with a total capacity of 3.3 gigawatts. Bp paid Equinor $1.1 billion in 2020 for a 50% stake in the venture.

Main players

Empire Wind is a 50-50 joint venture between Equinor and BP. Empire Wind has a body of water 25-30 miles southeast of Long Island and covers 80,000 acres. In this area, water depths range from approximately 75 to 55 feet. The lease was obtained in 2017. The two phases of the Empire Wind project 1 and 2 have a potential capacity of over 2 GW (816 + 1,260 MW).

Equinor is one of the world’s largest developers of offshore wind farms. Its U.S. operations include operating two leasing areas near New York, Empire Wind and Beacon Wind. Equinor also received a lease on the Outer Continental Shelf off California. The United States is an attractive growth market for Equinor with the ambition to install 12-16 GW of renewable energy capacity worldwide by 2030, the company reports on its website.

– bp’s ambition is to achieve net zero emissions by 2050 or earlier and help the world achieve net zero emissions – informs www.bp.com/us. The company emphasizes that “BP is transforming from an international oil and gas company into an integrated energy company – and America is the main element of this strategy. The bp company emphasizes that it “exercises a greater economic impact in the United States than anywhere else in the world, investing over $145 billion since 2005 and creating over 275,000 jobs.” jobs.

Success postponed

It has already been announced that energy from wind farms can power over 700,000 homes on good and bad windy days. houses per year. The projects will create over 830 jobs per year during construction and will sustain approximately 300 jobs per year during operation.

The declaration of the Biden-Harris administration had strong grounds to announce the program, because serious companies with extensive experience in the construction of offshore installations were involved in the wind farm construction project.

At the beginning of this year Great Lakes Dredge & Dock, together with its consortium partner Van Oord, has been informed by Empire Offshore Wind, a joint venture between bp and Equinor, of the termination of the rock placement contract for the Empire Wind 2 offshore wind project, which was scheduled to commence in 2026.

In 2022, the Great Lakes-Van Oord consortium was awarded a rock installation contract by Empire Wind for the Empire Wind 1 and 2 offshore wind farm projects with installation windows in 2025 and 2026, respectively. According to Great Lakes, Empire Wind 1 is currently on track on the way to installing the rock in 2025.

Contract wiped out by inflation?

But on January 3, 2024, the second part of the contract became questionable? Equinor and bp announced an agreement with the New York State Energy Research and Development Authority (NYSERDA) to terminate the offshore wind energy contract (OREC) for the Empire Wind 2 project, a U.S. offshore wind project with a potential generating capacity of 1,260 MW.

And New York State has set a goal of 9 GW of offshore wind capacity by 2035. – New York remains committed to the state’s clean energy goals and has taken steps forward by accelerating the acquisition of new PPAs to enable developers adjusting prices for inflation and developing more robust designs in the future. Decisions in the next bidding round are expected in February 2024.” – said Beyko.

This agreement reflects the changed economic situation across the industry and repositions an already mature project for further development while awaiting new opportunities for use. The decision acknowledged commercial conditions arising from inflation, interest rates and supply chain disruptions that made the existing OREC Empire Wind 2 contract unworkable.

Offshore dominoes

This decision set off dominoes and contracts with suppliers began to be terminated. Contracts signed with the Dutch manufacturer of foundations for offshore wind farms Sif and the Singaporean company Seatrium for the production of monopiles and an offshore wind substation as part of the project were canceled.

Equinor and bp say they believe offshore wind can be an important part of the energy mix and are committed to maintaining a significant contribution to state and local economies. But there are conditions that practically fall on the investor, i.e. the state administration and the USA. That is, on the taxpayer.

– Commercial viability is fundamental for ambitious projects of this size and scale. The decision on Empire Wind 2 provides an opportunity to reset and develop a stronger and more robust project in the future, said Molly Morris, president of Equinor Renewables Americas.

We will cooperate for dollars

Morris says, “We will continue to work closely with our many community partners across the state. As progress at the South Brooklyn Marine Terminal demonstrates, our offshore wind operations are poised to generate union jobs and significant economic activity in New York.”

“BP supports NYSERDA’s leadership and commitment to offshore wind, which we believe is a critical part of New York State’s and America’s clean energy future,” said Joshua Weinstein, bp’s president of offshore wind in America.

The Empire Wind 1 and Empire Wind 2 projects recently achieved a set of necessary federal permits after receiving the federal Record of Decision from BOEM. In October last year Empire Wind 1 also received in New York the Certificate of Compliance with Environmental Protection and Public Needs requirements pursuant to Art. VII.

In Europe (not) better than in the USA

In Europe the situation is not any better. The British Government has decided to increase the starting price for the next government auction for offshore wind by around two-thirds to £73 per MWh.

Germany announced in mid-2023 the winners of an offshore wind auction with a capacity of 7 GW for water areas that have not been previously developed by the state. It was the largest offshore wind auction in Germany to date.

The auction included three facilities with a capacity of 2 GW located in the North Sea (N-11.1, N-12.1, N-12.2) and one site with a capacity of 1 GW located in the Baltic Sea (O-2.2). The winners were bp for two sites in the North Sea and Total Energies for one site in the North Sea and a site in the Baltic Sea.

As a result, developers of offshore wind farms will have to pay a total of EUR 12.6 billion to the German government. 90% of the money will be used to finance the costs of connecting to the network, 5% will be used to protect marine biodiversity, another 5% will be used to support environmentally friendly fishing.

In Poland, PLN 15 billion per 1 GW?

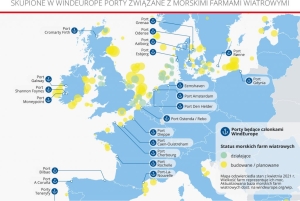

In Poland, a year ago it was estimated that approximately PLN 15 billion would have to be spent on the construction of offshore wind farms with a capacity of 1 GW. Today, these estimates will probably change, because they will also have to take into account the increase in costs throughout the entire supply chain and the construction of infrastructure from scratch on land and in large and small seaports.

Therefore, it can be assumed that 2024 will bring us a number of surprises. All the more so because many participants in the offshore wind energy supply chain announced that they would end the year with losses. Already in the summer, Ørsted shares fell by 25% after problems in the US offshore market were revealed.

The Danish energy company has already lost $5 billion on American projects. as a result of supply chain disruptions and high project implementation costs. The problems concern almost all elements of the offshore puzzle.

For now, there is no information that developers intend to abandon the development of wind farms in the Polish economic zone. There is also no information on how much the investment costs in Poland will increase and who will pay for them?