Record orders for eco ships. Seaports under pressure

By Marek Grzybowski

By Marek Grzybowski

Fleet decarbonization is accelerating along with orders for new ships. And although many innovative structures are being built in European shipyards, the beneficiaries of shipowners’ expenditure on fleet decarbonization are Asian shipyards. Mainly Chinese and Korean, which receive new technologies on a platter. Seaports must continue to invest in servicing ships powered by shore energy and bunkered with alternative fuels.

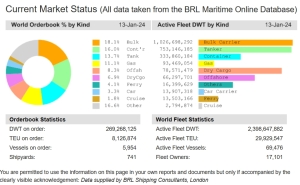

According to BRL Shipping Consultants, 2023 was the year with the highest number of new ship orders since 2015. The shipyards obtained contracts for approximately 1,914 naval vessels. More and more units are equipped with dual-fuel engines with LNG or LPG systems.

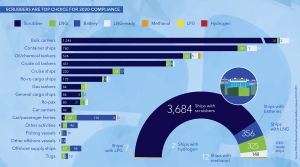

Orders of methanol engines and those adapted to run on ammonia are increasing. Few contracts include hydrogen power. Ships with electric drives, fuel cells and hybrid units are becoming more and more common. These are usually smaller units, such as small ferries, tugboats, barges, and service units in ports. They are not included in the mentioned statistics. Ships with wind-based technical systems should be added to this review. The most commonly used are rotors and folding sails. Several shipowners are also planning ships with nuclear power plants, including one mega container ship.

Tonnage for alternative fuels

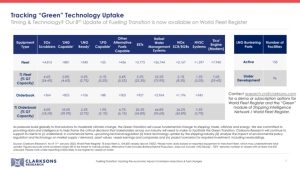

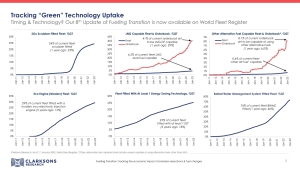

Clarksons “Green Technology Tracker” from January this year. informs that 45% of all new ship orders contracted in 2023 will have engines adapted to alternative fuels. These statistics also include orders for ships with gas-powered engines. And it is increasingly common to say that it is as much a fossil fuel as low-sulfur marine fuel derived from crude oil refining.

A better result was achieved in 2022 – a record number of orders for ships with engines powered by alternative fuels and gas. Throughout the year, it was as much as 61% of all new orders in terms of GT tonnage. But it was 35% of the contracted ships.

In 2022, shipyards placed 397 orders with a capacity of 36.4 million GT with dual-fuel engines and an LNG system. 43 orders (5 million GT) were made for methanol-powered engines. 17 ships (0.8 million GT) will have gas-powered engines with an LPG system. About 15 ships have been contracted with power plants that will have battery hybrid propulsion.

90 contracts (7.7 million GT) were ordered in 2022 with ammonia-fueled engines. 31 orders (1.0 million GT) are orders with LNG systems. Only three orders (15,000 GT) were placed for ships with a system capable of using hydrogen. Many of the ordered ships will be equipped with dual-fuel engines.

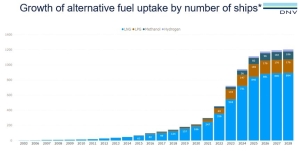

Steve Gordon, Global Head of Clarksons Research, reports that in 2021, 30.6% of the contracted GT tonnage had systems adapted to burn gas or alternative fuels. There were 483 units. This is an increase compared to 210 orders in 2020 and 49 orders in 2016.

A year of accelerating decarbonization

– 2023 was an extremely significant year in the decarbonization path of maritime transport, with the entry into force of new regulations and IMO recommendations committing to net zero emissions. And although we are only at the beginning of a significant and unprecedented investment program in the field of fleet renewal, 49% of the current tonnage covered by orders will be powered by alternative fuels – emphasizes Steve Gordon.

In 2023, 539 new orders were placed for ships adapted to use gas and alternative fuels. This is 45% of all contracts calculated by Clarksons Research by tonnage. The largest share of orders in 2023 continued to be ships with dual-fuel engines with an LNG system. There were 220 contracts, including 68 for LNG tankers.

The number of orders for dual-fuel ships, with methanol as the second fuel, increased to 125 ships. 55 of the new orders are ships with LPG systems, and only 4 ships will have ammonia-powered systems.

Shipowners had different approaches to the use of dual-fuel systems powered by gas and alternative fuels. Clarksons Research reports that 83% of newly contracted container ships and 79% of car carriers will be built in shipyards. The shares in bulk carriers and tankers are much smaller.

Taking into account gas power, currently only 6% of the world’s commercial fleet is powered by alternative fuels. In 2017 it was 2.3%. Gordon estimates that by the end of the decade this fleet with engines powered by gas and other fuels will increase to almost a quarter of the entire fleet and will approach 23% in 2030.

Must-have strategy

– Although new shipbuilding contracts are expected to be curtailed in 2024, the majority of ships ordered will be dual-fuel as shipowners clearly see engine technology as a ‘must have’ rather than something worth having to ensure operation of the new tonnage on traditional fossil fuels – says John Snyder, Managing Editor at Riviera Maritime Media.

John Snyder believes that “The motivation for these decisions is the inclusion of shipping in the Emissions Trading System (ETS) from January 1, 2024 and the entry into force of the FuelEU Maritime regulation in 2025.

DNV points out that a change in fuel technology is already underway in the maritime industry. Half of the tonnage ordered in 2023 will be able to use LNG, LPG or methanol in dual-fuel engines compared to one third of the tonnage ordered in 2022. “For ships in operation, 6.5% of tonnage can currently run on alternative fuels compared to 5.5% in 2022,” Snyder emphasizes, citing DNV data.

A technological revolution below deck

The technological revolution in ship power plants means that, according to Clakson Research, “eco” ships now constitute 32% of the world’s tonnage. On the oceans, as many as 50% of eco-friendly ships are VLCC and Capesize. The use of innovative Energy Saving Technologies (EST) is constantly growing. “7,295 ships in the fleet have significant ESTs, including 47 with wind power,” informed Steve Gordon.

Clarksons’ Green Technology Tracker also reports that 31 ships are testing on-board carbon capture technology. In the next two years, they will be joined by 22 ships built in shipyards.

Despite this, the decarbonization of fleets is not the best. Clarksons warns that its fleet is aging. Today, the average age of merchant ships is 12.6 years compared to the average ship age of 9.7 years a decade ago. “Our monitoring of ships under CII in 2023 indicates that over 30% of tonnage will be classified D or E, Gordon says, and recommends further investment in fleet modernization.

The revolution in the ship engine rooms

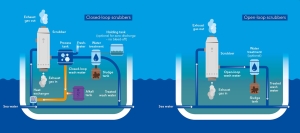

Gordon states that “The number of SOx scrubbers monitored has also increased year over year.” Taking into account planned modernizations, over 5,590 ships in the merchant fleet use various types of scrubbers. Last year Scrubbers were installed in the exhaust systems of 420 ships. And waste from scrubbers must be disposed of in seaports. As of today, orders for 2024 include 321 new scrubber installations. We also estimate that over 80% of global tonnage is currently equipped with mobile ballast water management (BWMS) systems. In addition, there are mobile BWMS systems in ports.

The revolution in ship engine rooms also has consequences in ports and terminals. Their operators must take into account technological developments on ships. Technical equipment and procedures for safe bunkering of ships with various types of alternative fuels must be prepared. Be prepared to operate ships with rotors and sails. Coastal electricity supply systems no longer apply only to ferries and passenger ships. Container ships and ro-ro ships also have installations enabling electricity to be collected from the quay.

Cooperation with crews of automated ships equipped with various power systems must have a legal framework and safety procedures. The technological revolution in shipping therefore requires significant modifications and investments in seaports.