European LNG market. EU ports receive over 200 deliveries annually from Russia’s Jamal LNG

By Marek Grzybowski

By Marek Grzybowski

In the period January-December 2023, LNG imports from European Union countries increased by 1.9% y/y to 102 million tons, to China by 11.4% y/y to 71.6 million tons, to Japan decreased by 9, 2% y/y to 66.9 million tons, to South Korea it decreased 3.5% y/y to 45.5 million tons – informs Banchero Costa Research in the latest report. By pumping Russian LNG in terminals in Belgium, Spain and France, the EU pumps $1 billion into the Russian economy every month. – says the latest CREA report.

The supply of LNG to ships increased and 1.7% more liquefied gas was transported between terminals on LNG tankers in the 12 months of 2023 than last year. Terminals pumped LNG from ships to onshore installations last year. approximately 409.9 million tons – informs Banchero Costa.

For comparison, the Świnoujście LNG terminal received 62 LNG tankers in 2023. Approximately 4.66 million tons of liquefied gas were received from them, i.e. approximately 6.43 billion m3. This was approximately 0.26 million tons of LNG more, i.e. 0.36 billion m3 compared to 2022 – according to data from PGNiG (ORLEN Group). The last cargo arrived at the terminal on December 29 under a long-term contract with the Qatari partner – QuatarEnergyLNG (formerly Qatargas). The Al Sahla gas carrier delivered approx. 90,000 tons of LNG.

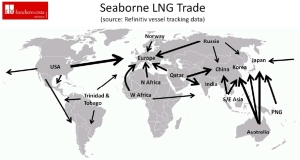

Since the beginning of operation of the terminal named after Lech Kaczyński in Świnoujście received 268 loads of liquefied natural gas. For over 5 years of operation of the terminal in Świnoujście, approximately 14 million tons of liquefied gas ordered by PGNiG were received, which after regasification corresponds to almost 18 billion m3 of natural gas. Most of the cargo came from Qatar and the USA. Several dozen deliveries were from Norway. Poland also imports gas from Nigeria and Trinidad and Tobago.

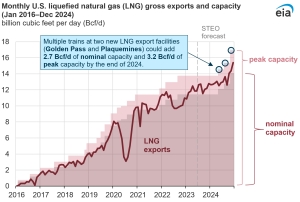

– In the coming years – with the commencement of further contracts with American LNG exporters – the number of deliveries from the USA to Poland will increase significantly. PGNiG – under agreements with GAZ-SYSTEM – currently reserves the full capacity of the terminal, i.e. approx. 5 billion cubic meters. regasification capacity annually. As it is expanded, it will have a capacity of 6.2 billion m3, and from 2024 – 8.3 billion m3 – announces PFNiG.

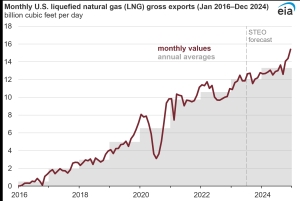

LNG deliveries from the USA grew particularly dynamically to the European Union and other countries. In the period January-December 2023, LNG transport across the Atlantic and Pacific increased by 12% y/y to 88.9 million. LNG exports from Australia recorded a decline by 0.6% y/y to 80.8 million, while LNG flows from Qatar on gas carriers decreased by 1.6% y/y and amounted to 78.6 million tons. Russia exported 6.1% less liquefied gas y/y and 30.9 million tons of it were delivered to LNG terminals by sea, reports Banchero Costa

Changes in EU supply sources

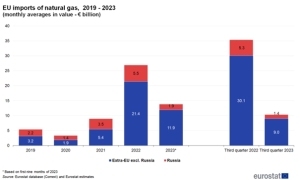

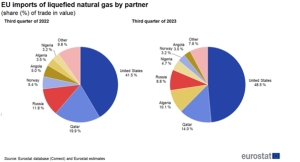

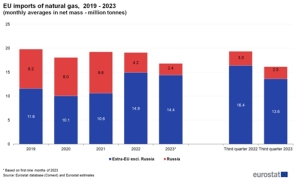

Still in the third quarter of 2021, Russia, with a share of 48%, was the largest supplier of natural gas in the gaseous state to the EU. In the third quarter of 2022, it remained on the podium with a share of 16.7%. Russian suppliers were overtaken by Norway (45.1%) and Great Britain (19.0%). Between the third quarter of 2022 and 2023, Russia’s share decreased by 0.7%. During the same period, the shares of Norway (by 3.5%) and Algeria (by 9.3%) increased. The share of supplies from Great Britain gas terminals decreased by 8.5% – informs EUROSTAT.

The increase in gas supplies by sea meant that the expenditure of EU countries on this energy resource was growing rapidly. Prices were rising due to extraordinary demand and the costs of changes in supply chains. After Russia’s attack on Ukraine, in 2022 there was an impressive increase in the value of monthly imports compared to 2021. This was caused almost exclusively by rising prices. The volume of natural gas imports in 2021-2022 remained almost constant.

After market stabilization, total average monthly imported gas values fell by 49% in the first three quarters of 2023 compared to 2022 as demand and prices fell. These events, combined with sanctions, reduced Russia’s monthly revenues from EUR 5.5 to EUR 1.9 billion, EUROSTAT experts calculated.

However, in 2022-2023, there was a significant change in suppliers and logistics chains. As a result, the increase in the average monthly volume of partners’ deliveries by 4.3 million tons was almost equal to the decrease in Russia’s LNG supply. – In the first three quarters of 2023, total monthly gas imports dropped to 16.8 million tons, which is a 12% decrease compared to the amount imported in 2022, says EUROSTAT.

It should be emphasized that this reduction could also be caused by adjustments to the import plans of some EU countries. Member States have committed to reducing gas consumption in the period from August 1, 2022 to March 31, 2023 by at least 15% compared to their average gas consumption in the same period over the previous five years – remind EU statisticians .

Decrease in LNG supplies from Russia

The decline in supplies from Russia continued in the first three quarters of 2023, when average monthly imports amounted to just 2.4 million tonnes. This represents a significant decrease compared to the 4.2 million tonnes delivered monthly to the EU in 2022.

EU ports receive over 200 deliveries annually from Russia’s Jamal LNG. The volume of imported LNG is now so significant that it has surpassed other forms of Russian fossil fuels. This follows from a report prepared by the Ukrainian organization Razom We Stand, calling for a complete and permanent embargo on Russian fossil fuels and an immediate cessation of all investments in Russian oil and gas companies.

– LNG was the basic type of fossil fuel purchased by the EU from Russia in the period January-November 2023 – emphasizes the latest report by the Center for Research on Energy and Clean Air (CREA), cited by Malte Humpert from “High North News” . He notes that “with a second project, Arctic LNG 2, scheduled to come online in the coming weeks, EU imports could increase further in 2024.”

Some EU LNG terminal operators facilitate the transshipment of Russian LNG to customers outside the continent. More than 20% of LNG from the Yamal region passes through terminals in Europe, where it is transferred from specialized, classy tankers to conventional LNG carriers for further transport.

– The key hub is the port of Zeebrugge, where Fluxys, the operator of the natural gas transmission system, operates a regasification and storage terminal. In 2015. the company signed a long-term storage agreement with Novatek, writes Humpert. The agreement is valid until 2035 and envisages pumping up to 8 million tons of LNG through the terminal. The contract guarantees the handling of loads delivered in approximately 105 transports.

LNG from the Arctic to the EU

LNG transfer has become a key element of Russia’s Arctic LNG policy. Its goal is to make maximum use of the Arctic fleet of LNG carriers. This policy was adopted under pressure from gas carrier suppliers. After Russia’s aggression against Ukraine, the South Korean shipyards DSME and SHI froze the execution of contracts for additional ice-class LNG carriers.

– European companies are also still involved in the operation of the Novatek LNG tanker fleet. Norway’s Assuranceforeningen Skuld, an Oslo-based marine insurance company, continues to provide coverage and liability insurance to three tankers carrying LNG between the Arctic and markets in Europe, notes Humpert.

A new Ukrainian analysis of the spread of Russian fossil fuels highlights the continued and unabated import of liquefied natural gas by EU countries. Unlike the United States, the EU has not yet imposed strong sanctions on LNG imports from Russia. As a result, the EU remains the destination for 50% percent of Russia’s LNG exports. As a result, the Russian budget receives over USD 1 billion per month.

– Russia has seen an increase in revenues from LNG exports, especially since its LNG remains unsanctioned by the EU. From December 2022 to October 2023, half of Russian LNG exports with a total value of EUR 8.3 billion were directed to the EU market, we read in a report by Ukrainian analysts. Although several EU countries have received Russian LNG since February 2022, the key importers remain Belgium, Spain and France, which together account for 88%. imports of Russian LNG to the EU in the last 10 months of 2023

Banchero Costa reports that spot charter rates for LNG carriers have been declining in recent months, with the Baltic LNGg Index declining 24.2% y/y in January-December 2023 compared to January-December 2022. Indicative long-term TC rates (over 15 years ) for a standard LNG carrier in December 2023 was estimated at approximately USD 74,000/day, and short-term (1 year) at approximately USD 62,000/day.