The Red Sea crisis and the US-China customs war are adjusting freight and liner connections. Mexico is the beneficiary

By Marek Grzybowski

By Marek Grzybowski

The average Drewry’s World Container Index fell 5% last week to $3,010 per 40-foot container, but is still high compared to last year. It is currently up 71% compared to the third week of March last year. Freight from Shanghai to New York is $5,376 per FEU. Container deliveries from China have increased dramatically to Mexican ports, with the same freight rates as those to the US east coast.

Despite the downward trends in March this year. then in the second half of March, freight per FEU container was 112% higher than the average rate in 2019 (before the pandemic) of $1,420 – calculated by Drewry analysts.

According to data from Basenton.com, the average price for sea transportation of a 20-foot container from China to Mexico is between $3,050 and $4,050. Freights vary depending on the route. For example, the average price for shipping a 40-foot container from Shenzhen to the port of Mexico in 2023 was from $4,850 per full container (FCL). For a container ship shipment from Shanghai to Mexico, the average freight was estimated from $4,150 per FEU.

The year-to-date average composite index is $3,453 per FEU container, $752 higher than the 10-year average rate of $2,701, Drewry reports. The latter amount was inflated by fluctuations recorded during the Covid-19 pandemic.

Freight in 2024 much higher than in 2023.

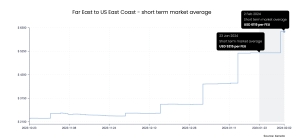

Already in early March, Xaneta analysts reported that the average XSI rate for Asia and the west coast of the United States dropped by 3% to USD 4,619 per 40-foot container. This was significantly higher than in the critical year of 2023, when only USD 1,316 per FEU was obtained in the last week of February. Back in December, before the Red Sea crisis, XSI was as low as $1,593 per FEU on spot markets.

Indices broke records on routes to the east coast of the United States, where maritime transport from Asia was directly affected by traffic restrictions on the Panama Canal and the need to extend routes around the Cape of Good Hope. Drewry WCI Asia to the US east coast closed the last week of February this year. with an average freight of $5,820 per FEU. This was 110% more in 2023 (in the corresponding week).

In February this year Xeneta’s long-term rate index recorded the largest increase in 18 months, partly due to carriers’ declarations of force majeure in current contracts. This allowed them to charge extra fees to shippers for redirecting ships bypassing the Red Sea.

Michael Braun, vice president of Xeneta, noted:

– We have seen the impact of Red Sea subsidies on long-term rates at a global level, but will we now see it at a regional level, particularly on trans-Pacific links? Importers to the US west coast will say this is an Asia-Europe problem and we are not willing to pay more. Carriers will say it’s a global problem because we need to shift capacity from Pacific routes to other routes that are directly affected by the need to bypass the Red Sea, says Braun, emphasizing that this is “a million-dollar question before negotiations because both carriers and forwarders take extremely tough stances. The problem is that the difference between them is several thousand dollars per FEU in terms of the business goals they are pursuing.”

There will be shifts between routes

It is interesting to note that “imports to the US East Coast are more directly impacted by diversions from the Red Sea than from the Pacific Ocean network.”

– Cross-Pacific shipping rates are driven by supply and demand. But imports to the East Coast are affected by the situation in the Suez Canal or Panama Canal. Both routes have many negative consequences and an increase in costs is inevitable, Barun states firmly.

He says: – If I am a professional transporter of goods from India to the East Coast of the United States, I currently expect my costs to double on the spot market.

And here a new thread appears. It turns out that Mexico is rapidly developing trade relations with China. Mexican ports are swelling with Chinese supplies. Market analysts quickly determined that the sharp increase in container imports from China to Mexico was a way for Chinese goods to reach the US through the “back door”, thus bypassing US sanctions on goods imported directly from PRC factories to US recipients.

According to freight benchmarking firm Xeneta, “a staggering 60% year-over-year increase in container imports from China to Mexico in January 2024 raises suspicions that Mexico is becoming a backdoor entry into the U.S. market.”

Mexico – the “door” to the USA

Taking into account the increase in the number of transported TEUs from 73 thousand in January 2023 to 117 thousand TEU in January 2024, Xenet analysts consider this direction to be one of the most dynamic trade routes in the world. Xenet analysts note that there was a 34.8% increase in container shipments between China and Mexico in 2023, a huge jump compared to the modest growth of 3.5% in 2022.

Xeneta’s chief analyst, Peter Sand, highlights the potential correlation between the escalation of the trade war, increased tariffs on goods imported from China to the US and the dynamically developing trade between China and Mexico.

– Trade between China and Mexico grew in 2023. But the latest data for January 2024 shows a huge increase. It is currently probably the fastest growing trade in the world, said Sand.

Sand attributes the dynamic growth in trade between China and Mexico to the strategy of importers who use a simple technique to circumvent US tariffs. Much of the goods arriving in Mexico from China likely end up in the US.

– In a purely hypothetical scenario, if this growth rate continues, by 2031 there will be more containers imported from China to Mexico than to the US West Coast. This shows how quickly the demand for sea freight is growing – notes Sand and emphasizes that on March 14 this year, freight from the eastern ports of Mexico and the USA reached almost the same level.

Sand summarizes:

– The maturing trade is also potentially volatile, both in terms of maritime transport costs and service reliability. If importers decide to move ocean supply chains to Mexico’s west coast, there are risks involved. This is a perfect example of how the “best option” for shippers can change over time as the market evolves.

Changes to the linear sea routes in the Pacific should not have a significant impact on connections between Asia and Western Europe. Operators will try to cover the increased expenses for bunkering and insurance resulting from the extension of routes.

For now, freight rates from Shanghai to Rotterdam and Shanghai to Genoa are down 8% to $3,209 and $3,882 per 40-foot container. Similarly, freight rates from Shanghai to Los Angeles dropped 4%, or $148, to $3,934 per FEU, respectively, Drewry analysts calculated.

Freight on the Rotterdam to Shanghai route decreased by 2% to $827 per 40-foot container. Meanwhile, rates on the Rotterdam to New York and New York to Rotterdam routes increased by 2% to $2,281 and $658 per 40-foot container. Drewry expects spot freight rates from China to decline further in the coming week.