European countries on oil smuggling maps. Russian oil leaks in ‘shadow fleets’

By Marek Grzybowski

By Marek Grzybowski

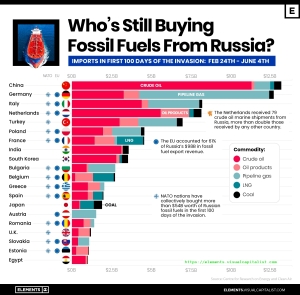

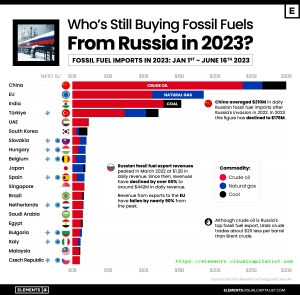

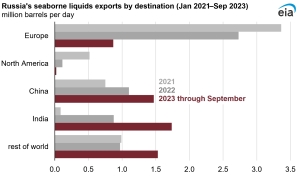

Russian oil and refinery products reach all countries, including EU countries. Despite the economic slowdown, the refining industry and its industrial customers cannot stop. Crude oil from Russia reached the refineries in 2023 without any major obstacles. In 2024, it will continue to flow in a wide stream on tankers to European ports and refineries.

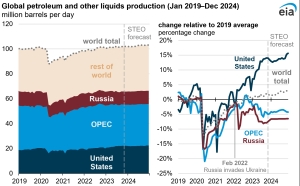

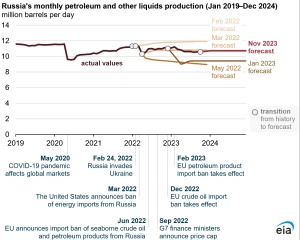

The US Energy Agency EIA states directly: “Russia, together with other countries not participating in the sanctions, launched logistics services aimed at avoiding sanctions and G7 price caps, which led to more markets being available to Russia than we expected. In the latest STEO forecast, we expect production in Russia to average 10.7 million barrels per day in 2023 and remain essentially unchanged in 2024.”

The BBC reported that “millions of barrels of fuel made from Russian crude oil continue to be imported into the UK despite sanctions imposed on the Kremlin over the war in Ukraine.” The Center for Energy and Clean Air Research (CREA) noted that this “refining loophole” means that countries such as India and China that have not imposed sanctions on Russia are able to legally import Russian crude oil and refine it to produce petroleum products , such as jet fuel and diesel, and then export these products to the UK and EU. More GospdarkaMorska.pl

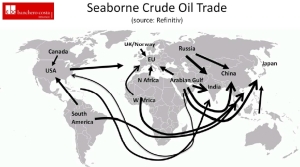

The problem has been growing since the beginning of Russia’s attack on Ukraine. After a brief turmoil, tanker operators and shippers quickly rebuilt markets and supply chains. Oil flows to final consumers through ports around the world. Transhipment in ports through fuel terminals and in roadsteads or closed water areas between ships has become an everyday occurrence.

Oil leak map

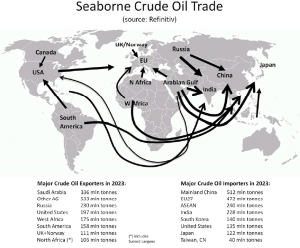

The oil transport map in 2023-2024 has changed a little, but it perfectly illustrates that the oil market hates gaps. “Oil is the most frequently seaborne bulk commodity in the world – 38 million barrels per day, or 2 billion tons per year,” notes Banchero Costa in the latest report. Sea freight volumes have not increased significantly over the past decade.

However, the transport structure has undergone a radical transformation. Refineries, mainly oil producers from the United States, began to play the role of an important player on the crude oil export market. China continues to be the main source of demand growth.

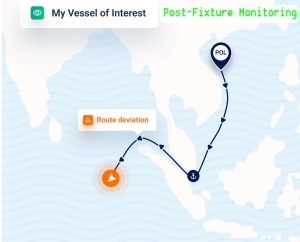

The last quarter of 2023 was a turning point for the global tanker fleet. Their role in the logistics of deliveries via sea routes has increased. Operators quickly began to operate in market gaps and participate in global maritime operations of oil transfer and bypassing sanctions – emphasizes Windward in its April report.

The report provides an in-depth analysis of newly developing risk regions, an overview of global trends and highlights the specifics of recent geopolitical changes, Windward reports. The report highlights tanker behavior by analyzing recent events, sanctions compliance and fraudulent shipping practices, including smuggling activities, ship-to-ship (STS) operations and location manipulation (GNSS). The latest analysis takes into account new risks caused by blocked routes through the Red Sea. They were described as: “New regional risk”.

Houthi attacks in the Red Sea (including even on a Russian ship) caused a number of disruptions in the supply of oil and refinery products. It was necessary to correct the routes and develop new delivery strategies.

New areas of STS operations

One of the actions of “dark” fleet operators is to disable identification systems on ships. “The average monthly AIS transmission loss in the Red and Arabian Seas by cargo ships and tankers from January to October 2023 was 380 and 207, respectively,” Windward reports. Between November and December 2023, this average increased by 58% and 55%.

In the last quarter of 2023, changes in the destination ports of deliveries made on global crude oil trade maps were clearly visible. Information collected from fuel terminals clearly shows a sharp increase in the number of destination port changes. The uncertain situation in the Red Sea has changed oil supply routes and Windward identified that “60% of destination updates were mainly made by bulk and container ships.”

Experts highlight shipowners’ decisions to adjust the route around the Cape of Good Hope by identifying the first passage around the southern tip of Africa.

The average weekly number of such first visits in 2023 was four. In the last week of December 2023, there was a 450% increase in the number of container ships and a 100% increase in the number of tankers sailing around the Cape of Good Hope, Windward analysts found. Importantly, in the case of general cargo and bulk carriers, the weekly average did not change much, despite the increase in political and military tension in the area.

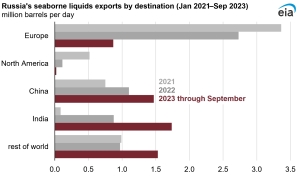

In this confusion, operators transporting Russian crude oil and products made from it have found their niche. However, they experienced the entry of new suppliers into the market and reduced demand in some markets. Analysts compared the number of direct sailings from Q4 2022 to Q4 2023. Windward states: “we see an unprecedented decline in direct oil exports from Russia of 21%. In the previous quarters of 2023, the averages were at a level similar to the same period last year.

Are Russian oil supplies decreasing?

In the third quarter of 2023, the average number of direct deliveries of Russian oil was 26. In the fourth quarter of 2023, this number decreased by 11%. Bottom line: Russian oil volumes to the US/EU/UK appear to be declining steadily, but have not yet completely stopped, even with advanced sanctions in place.

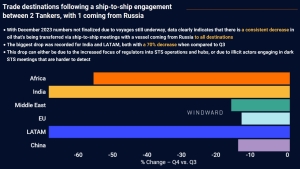

New regions have become active on the global oil trade map, where crude oil from Russia is reloaded onto tankers, which deliver oil from a new source. New maritime hubs were identified in the fourth quarter of 2023. Ship-to-ship transhipment operations between two tankers were taken into account, with one of the ships coming from Russia.

“In the Cyprus EEZ we are seeing a 500% increase in ship-to-ship STS operations and in Catania there has been a staggering 3,000% increase!” – says Windward. The increase in transhipments near Cyprus coincides with the decrease in the number of all other water areas where STS operations were carried out with the participation of ships from Russia.

There were no such operations near Crete, near Malta and Ceuta they dropped by 70% and 50% respectively. However, in the waters around Malacca and the coast of the Persian Gulf, increases of 118% and 100%, respectively, were recorded compared to the third quarter of last year. After Senegal recorded a 70% drop in STS transshipment in the third quarter, ships from Russia returned here in the fourth quarter and the STS increased by 150%.

The largest declines in STS operations were recorded in India and Latin America, both by 70% compared to Q3. “This decline may be due to either increased regulatory focus on STS operations and centers, or illicit participants engaging in dark STS meetings that are more difficult to detect,” Windward suggests.

The black fleet is growing, the risks are growing

“In Q4 2023, the shadow ship fleet grew by 29% and included over 1,800 ships. Over the same period, the number of gray fleet ships decreased by 24%,” Windward calculates. This is justified by a more effective process of tightening regulations. But it may also be due to operators being better able to conceal the origins and ownership of the ship and cargo. The dark fleet is dominated by ships whose operators choose to fly under flags offered by Panama, Liberia and Russia. Gray fleet operators most often fly the flag of Russia, Liberia and Panama.

Deceptive shipping practices (DSP) are still common. Ship captains, forwarders and operators use various tricks to avoid detection, sanctions and restrictive regulations (including safety). There are still a large number of operators engaging in illegal activities such as oil smuggling and illicit trade.

Fraudsters are extremely flexible and quickly adapt tactics to avoid sanctions. They effectively exploit loopholes in existing regulations and sanctions. Windward found that “67% of all medium- and high-risk vessels in the fourth quarter of last year it sailed under a flag that allowed trade with Russia and the countries it imposed sanctions on. Official sanctions covered only 5.9% of ships linked to at least one sanctioned country.

The EIA states explicitly: “We assumed that the limited number of non-sanctioned ships under the G7 leadership would limit Russia’s ability to export refined products. Without export markets and significant surpluses in storage capacity, Russia would have to reduce refinery operations and crude oil production. However, the number of tankers available and the willingness to transport Russian oil exceeded our initial expectations.”

Bypassing sanctions, although reprehensible, means that freight and oil prices no longer jump as much as in 2022, and planners at fuel terminals, refineries and chemical industry companies have calmer days. Only the prices of tankers on the secondary market continue to rise.