China’s shipbuilding industry is on top. Supported by shipowners and partners from Europe

By Marek Grzybowski

By Marek Grzybowski

From 2023, the shipbuilding industry is experiencing a boom in new construction. The beneficiary are shipyards from the PRC, with a portfolio of orders for new ships until at least 2028. Demand for virtually all ship categories is maintained. At the beginning of 2024, the PRC shipbuilding industry is working at full capacity with deliveries scheduled for the next 5 years.

At the beginning of April, SEA Europe published another document inviting EU authorities and European governments to support the European shipbuilding industry with subsidies and orders. SEA Europe is calling for the reconstruction of the industry under the slogan contained in the name of the declaration announced on April 8: “Setting sail to build in Europe 10,000 sustainable and digitalized vessels by 2035 – SEA Europe’s call for a European Maritime Industrial Strategy”.

China’s shipyards house both bulk carriers and container ships, as well as more complex structures, including ferries and ro-ro ships, as well as specialized and passenger vessels. The order portfolio for ships has expanded significantly (it is already production for government orders). Chinese shipyards produce increasingly complex and innovative ships. Many of these innovations are transferred directly from Europe to China.

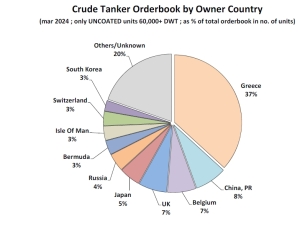

Shipowners from Europe place contracts in China

European shipowners place orders in Chinese shipyards, ensuring production for at least 5 years. Because options for extending the series provide much longer prospects. One contract concluded 20 years ago can extend the shipowner’s marriage with the Chinese shipyard for many years. There are many examples from all over Europe, and even from the Baltic Sea region and Poland.

2024 is a special year for Chinese shipyards. Contracts are falling apart because this is where orders for tankers are placed. And the demand for this type of units has increased enormously. Analysts from Clarkson Shipping Intelligence, Banchero Costa Research and other companies dealing with the market draw attention to this.

Oil tankers on top – 490% y/y

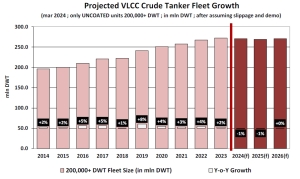

In the first two months of 2024, contracts for new oil tankers increased to 7.4 million dwt, which means an increase of 490% y/y, due to the increase in orders for the very large tanker market – VLCC – informs Filipe in a March report Gouveia, a shipping analyst at BIMCO, calculates: “As many as 19 VLCCs were ordered in January and February 2024, which already exceeds the number of orders for this type of ships in the entire 2023.”

Since the beginning of the war in Ukraine, freight rates for oil tankers have skyrocketed. They also remained at a level satisfactory to operators in the first two months of 2024. The average Baltic Exchange Dirty Tanker Index increased slightly compared to the first two months of 2023, providing the highest average for January and February since 2006. VLCCs recorded their strongest start to the year – informs BIMCO.

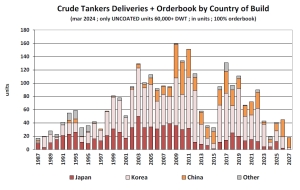

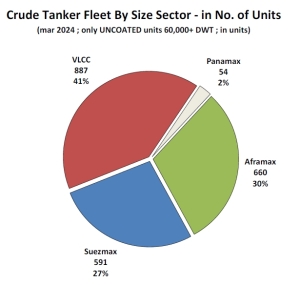

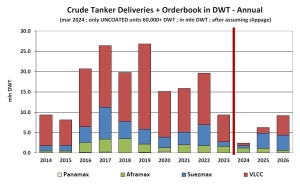

– Deliveries of crude oil tankers with a deadweight capacity exceeding 60,000 tonnes. tons reached the highest level in 2017 and amounted to a total of 131 units with a deadweight capacity of 26.44 million tons – reminds Banchero Costa Research and informs that in 2023, shipowners took delivery of 43 units (9.37 million dwt).

– We expect the production of approximately 16 units with a deadweight capacity of 2.36 million tons in 2024 after taking into account the slippage in the production of several tankers – informs Banchero Costa Research.

In March 2023, the oil tanker order book represented only 3.3% of the tanker fleet, the lowest level since at least 1996. However, in 2023, orders for Suezmax vessels increased rapidly, followed by orders for VLCCs. By February 2024, the tanker order-to-fleet ratio (in terms of deadweight capacity) had increased to 6.2%. Despite the high contracting rate, the ratio of the VLCC order portfolio to the entire fleet capacity remained at 4.3%.

– As stated in our recent Oil Tanker Market Overview and Forecasts report, the near-term outlook appears positive for oil carriers. Supply and demand imbalances may increase. The reason is limited fleet resources for transporting oil over longer distances. The outlook appears particularly favorable for VLCC vessels and may support freight rates in this segment, Gouveia says.

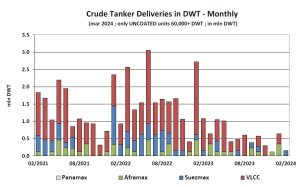

Banchero Costa Research found that the transfer of at least 5 units with a total deadweight capacity of 0.8 million tonnes was reported in January-February 2024. It was 78.9% less y/y on a dwt basis. Among the received tankers was one VLCC with a deadweight capacity of 300,000 tonnes. tone.

Demand for VLCC tankers

VLCCs typically transport crude oil from the Middle East and the Americas to Asia. – In the coming years, we expect more oil to come from the Americas and oil demand to increasingly shift towards Asia. This would not only increase shipping distances, but would also benefit VLCC operators in particular, as they dominate these trade routes, reports Filipe Gouveia from BIMCO.

The suppliers of VLCC tankers are mainly shipyards from China. So the current market situation favors shipyards specializing in the production of tankers, especially the largest ones.

– China currently dominates the global order portfolio for new units. This applies to container ships, car carriers, bulk carriers and tankers, says Adam Kent, managing director of Maritime Strategies International (MSI), in a statement on the Seatrade Maritime Podcast.

MSI estimates that 102 million GT ships were placed under contract in Chinese shipyards in 2023, with Korean shipyards taking a “distant second place”. – The difference with the Korean order portfolio is that more than half of the Korean order portfolio are gas carriers. Although Chinese shipyards are starting to build more and more gas carriers, this certainly remains the domain of the Korean shipbuilding market, explains Kent.

MSI expects new orders in 2024 to decline to levels seen in recent years. – The order portfolio mainly includes large tonnage, so we expect that significantly fewer container ships will be ordered. I think, as expected, we are at the end of the current ordering frenzy in the LNG sector. So we do not expect that in 2024 these volumes will be the same as we recorded in 2022 and 2023,” says Kent.

In terms of placing new orders, MSI says owners looking to contract with high-producing shipyards in China, Korea or Japan will likely receive an earliest delivery date of 2027.

If an investor is considering ordering a standard-design Capesize bulk carrier, Kent says there is still some capacity available at China’s second-tier shipyards to allow for delivery in 2026. The production of tankers in Japanese shipyards remained at a good level until 2011. The last decade has been a struggle with competition from China and South Korea. South Korea shipyards have maintained a strong market position over the last twenty years. However, it was a period of constant transformations and the government throwing lifelines. China turned out to be the main player in this market.

sources: Banchero Costa Research, BIMCO, Clarkson, Xinhua, COSCO Shipping