Alarm for ports. Activation of the European Union industry is needed

By Marek Grzybowski

By Marek Grzybowski

German, Belgian and Dutch ports are sounding the alarm: Europe, join forces to protect industry. The reduction in transshipment in North Sea ports has led port authorities to unite and call on the EU institutions for help. However, it is not only about direct aid for ports. We need to save European industry, because it determines the condition of ports located near the heart and lungs of the European energy, chemical and steel industries.

– The manufacturing industry in the triangle between the Flemish-Dutch ports and the German Ruhr area accounts for a large part of European production. Companies from the chemical and steel industries locate in ports to supply (still largely fossil) raw materials and energy. These are significant emitters with the main responsibility for quickly reducing greenhouse gas emissions, warn North Sea port managers.

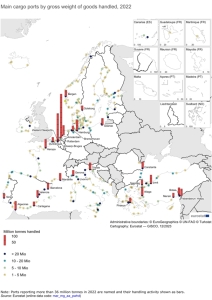

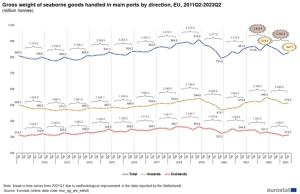

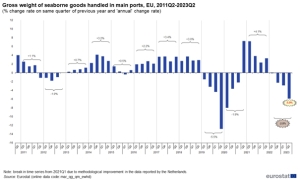

The fact that ports have been affected by the economic slowdown in industrial regions is evidenced by the transshipment in 2023. The 10 largest European container ports transhipped a total of 62.8 million TEU in 2023, which means a decrease of 4.3% compared to 2022. But the weakening economic situation in the EU was already noticeable much earlier. This can be seen in Eurostat’s statistical information.

Rotterdam and other seaports on the edge

In the port of Rotterdam, the largest container port in Europe, a total of 13.4 million TEUs were transhipped, which is 7% less than in 2022. In total, in Rotterdam in 2023, 438.8 million tons were transhipped in bulk, liquid and general cargo terminals, i.e. 6.1% less than in 2022. Bulk carriers caused the supply in 2023 to be 11.8% lower than in 2022, while container turnover in tonnes was 6.8% lower in 2023 at 130.1 million tons.

The total cargo transshipment of the port of Antwerp-Bruges amounted to 271 million tons of cargo, a decrease of 5.5% compared to the previous year. All main groups in the turnover structure decreased, except for the supply of passenger cars.

Container traffic, which accounts for half of the port’s turnover, decreased by 6% in tonnes and 7% in TEUs. In total, five container terminals in the port of Antwerp and one in the port of Bruges transhipped a total of 12.5 million TEUs at the end of the year. The decline amounted to approximately 5.5% in the first half of the year, and in the second half of the year it increased by over 9% year-on-year.

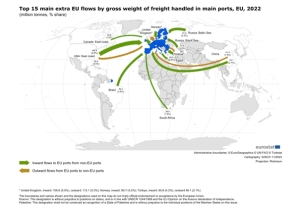

– Tension in the Red Sea may lead to an increase in rates for the maritime transport of goods from Asia to Europe by 60%, with an increase in insurance by 20% – announces the Port of Antwerp Authority and forecasts that “The increase in freight rates will probably be a factor in further limiting the movement of goods from Asia to European ports.

In 2023, companies operating in North Sea Port reloaded 65.9 million tons of cargo that arrived at the ports by sea or were exported from there. This means a decrease of 11%, or 7.8 million tons of goods, compared to the record year of 2022. Worse results were recorded in inland transport. More than half of transshipment in 2023 was dry bulk cargo, 53%. In total, 35.2 million tons were transhipped and it was 12% less than in 2022. Coal supplies mainly decreased (by 27%). The share of containers in total transhipment has remained stable at 3% since 2019. In 2023, 2.2 million tons of cargo were transhipped in containers. This was 6% less than in 2022.

Port presidents are sounding the alarm

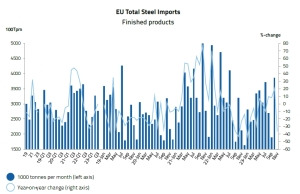

More months of economic slowdown are behind us. – In January 2024, compared to January 2023, industrial production decreased by 6.7% in the euro area and by 5.7% in the EU – informs Eurostat. Of the Member States for which data is available, the largest monthly declines were recorded in Ireland (-29.0%), Malta (-9.4%) and Estonia (-6.6%). The largest increases were observed in Poland (+13.3%), Slovenia (+10.6%) and Lithuania (+7.2%).

Ports, like never before, have become a mirror of the weakening condition of European industry. Boudewijn Siemons, CEO of the Port of Rotterdam, Daan Schalck, CEO of the North Sea Port, Jacques Vandermeiren, CEO of the Port of Antwerp-Bruges, and Markus Bangen, CEO of Duisburger Hafen AG, appealed to the European institutions for support for European industry.

The fact is that the concept of the single European market requires significant modification. The European market has not been protected or strengthened. Many industries have even been weakened or simply eliminated. This was demonstrated by the crisis caused by the disruption of supply chains during the pandemic.

The photovoltaic panel production industry practically does not exist. The automotive industry depends on supplies from China. The shipbuilding industry is developing in the shadow of the Asian tigers from China and South Korea. The good condition of industry, not consumption, has a significant impact on the condition of ports.

– Thanks to companies [operating in the EU – Ministry of Economy], we can produce electronics, medicines and consumer goods in Europe. This also applies to wind turbines, insulating materials and solar cells – emphasize the presidents of port authorities and warn that globalization is having a negative impact on Europe because: “however, to a large extent, international major concerns are wondering whether they still see a future in Europe. This is extremely important to us because industry in particular can make a significant difference in making our society more sustainable.”

Not long ago, ports were competing for priority in transshipment, comparing who was the biggest or the best. Now the CEOs of the Port of Antwerp-Bruges, the Port of the North Sea, Duisburger Hafen AG and the Port of Rotterdam have decided to focus on what they consider to be the most important issue: “How can we unite to ensure a sustainable industrial future in Europe.”

Ports and industry on the network (pipelines)

– That is why, as ports, we want to take a leading role in improving the investment climate for industry in Europe, so that relevant companies want to invest in sustainable development. Companies operating in the [European industrial triangle – MG] are, quite literally, connected by a network of pipelines. They cooperate, supply each other with raw materials and share knowledge – emphasize the presidents of ports operating in northern Europe near the Ruhr area.

In their opinion, all ports and industrial clusters are adapting their infrastructure to future raw materials and energy. The future includes, among others: hydrogen. The idea is “that even a sustainable industry can continue to cooperate effectively.” Joint planning and investing are needed. – And honestly, we could do it more often and sometimes more effectively – point out port presidents.

– As owners of large industrial complexes, we strive to work based on a common vision. Space in ports is already limited, and processes such as more sustainable and circular production require much more space and can sometimes have a temporary, additional impact on the environment, say the CEOs of North Sea ports.

Hence the appeal to political and industrial bodies to “work together to determine what action we really need in Europe. Where is this space available, both physically and regulatory-wise? What will our ports and industries look like in 2050 when they become climate neutral?”

A common vision is needed

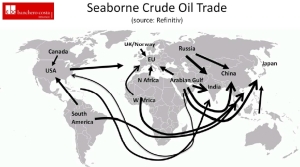

The appeal was addressed not only to European institutions but also to governments that should look at ports from a global perspective. The role of ports as important nodes in the global logistics chain has significantly increased during the pandemic. After Russia’s attack on Ukraine, it turned out that ports are strong links ensuring energy and food security.

The presidents of the mentioned ports call “for European government leaders to stand on the side of the industry, just like us. “Energy-intensive businesses result in much higher costs in Europe than in other parts of the world and must cope with more complex rules and regulations.”

The activity of the government in the United States is an example of good solutions. The government’s support package resulting from the Inflation Reduction Act makes, in their opinion, “investing in the necessary renewal in this country more attractive for companies.”

– If [European – Ministry of Economy] governments do nothing in return, investments in sustainable development in Europe will stall and the industry will move outside Europe – CEOs warn.

The vision is apocalyptic. They believe that “Existing plants will then continue to operate as long as possible until they become obsolete and eventually close.” In their opinion, greater imports to Europe from countries whose economies do not comply with climate restrictions have “negative consequences for the climate, our strategic autonomy and prosperity.”

Industry and ports are one thing

– We hope that the industry will find strength in Europe; after all, it provides key support for our ports, logistics and energy. These sectors provide approximately EUR 63 billion in added value and over half a million jobs, emphasize port presidents.

That’s why European government leaders must combine climate and industrial policy in their five-year plan, say the presidents of North Sea ports and call for the “Antwerp Declaration on the European Industrial Agreement.” Ecological activities cannot obscure the strategic goal of developing innovative industries in Europe.

It should be noted that today as many robots are assembled in China each year as in other countries. Right behind them are South Korea, Singapore and Japan. Together with Germany, these are the five most robotized countries in the world. The statistics concern the number of robots per 10,000. employees.

Directors Boudewijn Siemons, Daan Schalck, Jacques Vandermeiren, Markus Bangen issued an appeal to the leaders of European governments on the eve of the European summit, which took place on April 17 and 18.

The topic of cooperation between ports and industry is coming back like a boomerang. Always at a time when the competitiveness of the European Union industry is weakening and the synergy effect of the EU single market is weakening. There is not only a topic for North Sea Ports. It will also be worth discussing it at the Polish Ports 2030 Congress, which will be held in June 2024 in Sopot under the patronage of Deputy Minister Arkadiusz Marchewka, Secretary of State at the Ministry of Infrastructure.