Investments on the Silk Road drive (not only) China’s maritime business

By Marek Grzybowski

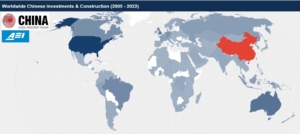

Chinese companies were involved in 147 countries with an estimated amount of USD 67.8 billion through financial investments and contractual cooperation under the Belt and Road Initiative (BRI) in 2022. This is slightly less than China’s involvement in BRI in 2021, which amounted to USD 68.7 billion, according to data from the Ministry of Commerce of the PRC.

Approximately USD 32.5 billion was allocated to direct investments, and USD 35.3 billion were construction contracts, which were partly financed by Chinese loans. Following the Covid-19 pandemic, China’s investment exposure in international markets has shown steady growth since 2020.

Cumulative investments under the BRI since the announcement of the BRI in 2013 amounted to USD 962 billion, of which approximately USD 573 in construction contracts and USD 389 in non-financial investments, enumerates Dr. Christoph Nedopil Wang, director and founder of the Green Finance & Development Center, associate professor at Fanhai International School of Finance (FISF) at Fudan University in Shanghai.

China’s average investment deal size increased from around US$444 million in 2020 and US$476 million in 2021 to US$650 million in 2022. This is the highest value since 2019. Compared to the peak in 2014, the investment deal volume is 21% smaller. In the case of construction projects, the transaction volume in 2022 was the lowest since the announcement of the BRI in 2013, as it decreased to USD 321 million compared to USD 530 million in 2021 and USD 386 million in 2020, according to data from the Ministry PRC Trade.

China’s investment involvement in BRI focuses on the energy sector (36% of expenditures) and the manufacturing sector for transport (18%), which, compared to 2021, is an increase in the total value by 60%. This is a continuation of the previously adopted strategy. This was noticeable in 2021.

Chinese involvement related to the energy sector accounted for the bulk of China’s BRI spending. In 2021, the total exposure in the energy sector was approximately USD 22.3 billion. This compares to an exposure of over USD 26.1 billion in 2020 and almost USD 44.8 billion in 2019. In 2021, the majority of investments in the energy-related sector concerned oil processing (31%), followed by use of solar and wind energy (31%) and gas (22%).

Source; Lommes – Own work, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=58884083

Source; Lommes – Own work, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=58884083

More: Investments on the Silk Road GospodarkaMorska.pl