106 largest wind turbines on Cuxhaven production lines for Wind Farms in the North Sea

By Marek Grzybowski

By Marek Grzybowski

Ownership changes in the wind energy market support large-scale investments. The factory in Cuxhaven is working at full capacity, says Ørsted. Soon, 106 gondolas will be delivered to the Gode and Borkum Riffgrund offshore wind farms in the North Sea. Production and investments in offshore wind energy are supported by ownership transformations and organizational changes in corporations.

The pace of installation on Gode Wind 3 and Borkum Riffgrund is not slowing down. This became possible because Ørsted signed an agreement to sell 50% of the Gode Wind 3 offshore wind farm in Germany to funds managed by Glennmont Partners from Nuveen (“Glennmont”).

The transaction was announced earlier. Glennmont is one of the largest fund management operators in Europe. It focuses exclusively on investments in the expansion of clean energy infrastructure. Owned by Nuveen, a TIAA company and global asset management company with over $1.1 trillion in assets. It is among the 20 largest infrastructure managers in the world.

The value of the Gode Wind 3 project was estimated at EUR 473 million (approx. DKK 3.5 billion) and includes the price for the acquisition of 50% of shares in the offshore wind farm and the obligation to finance 50% of the construction of Gode Wind 3.

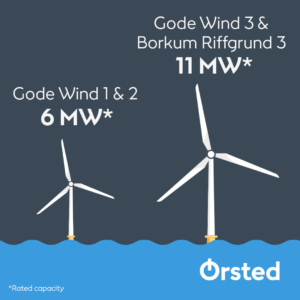

11 MW times 106 wind turbines

106 wind turbines will be delivered from the Cuxhaven Siemens Gamesa factory to German wind farms. The 97-meter blades will later be attached to each turbine, the manufacturer informs. The wind turbines with a rated power of 11 MW and a rotor diameter of 200 meters will be the largest ever installed in the German zone in the North Sea.

– Turbine installation will begin at sea next year – we will keep you updated on the progress on our channels, so stay tuned! – informs Siemens Gamesa on Linkedin.

On June 13, 2023, minority shareholders of Siemens Gamesa agreed to reduce the capital of the remaining 2.21% of the shares. This paved the way for the full integration of Siemens Energy with Siemens Gamesa and signals their common future, and Siemens Energy AG became the sole shareholder of Siemens Gamesa.

253 MW + 900 MW from offshore wind

Gode Wind 3 is scheduled to be commissioned in 2024. It will have a total capacity of 242 MW. Once operational, Borkum Riffgrund 3 will provide a total capacity of 900 MW. Commissioning of the complete installation and full operation is planned for 2025. Both projects will be equipped with Siemens Gamesa 11.0 -200 DD turbines.

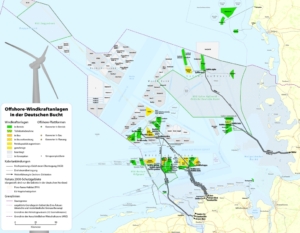

A license to invest in the German waters of the exclusive economic zone was granted to Ørsted in 2017 and 2018. These were two separate projects with a weighted average feed-in tariff of EUR 81 per MWh. Gode Wind 3 is currently under construction next to the Borkum Riffgrund 3 offshore wind farm, already owned by Ørsted and Glennmont. In addition, Glennmont also co-owns Ørsted’s Gode Wind 1 offshore wind farm.

In spring 2021, Ørsted and MDE Consultants signed a four-year framework agreement to provide staff for Ørsted’s offshore wind farms in Germany.

Wind outsourcing in the production of offshore farms

Under the agreement, which entered into force on March 1, 2021 and will last until 2025, MDE Consultants will provide qualified personnel throughout the life cycle of the developer’s offshore wind projects. The full scope of work includes providing technical staff for construction and electrical installations, as well as employees with authorizations for operational activities and logistics.

MDE will also be responsible for recruiting staff for project management, wind farm commissioning and other tasks related to equipment operation (O&M).

– This transaction complements the previous framework of agreements between the two companies, covering projects in the UK, Denmark, Taiwan, the Netherlands and Poland – informed MDE Consultants. This is important information for Polish companies that intend to enter the market of offshore wind farm installations in the Polish economic zone with their services and staff.

Taylor Hopkinson will manage staff and logistics

In the case of offshore wind farms, the contract was awarded to Taylor Hopkinson. The company will be responsible for providing staff under the framework agreement signed with Ørsted. The company provides contract staff in a variety of positions on assigned lots. From construction, engineering, operation and maintenance to project management and commissioning. This agreement entered into force on March 1 and will last until 2025.

– We continue to observe great interest from investors in offshore wind farms and we are very pleased to once again welcome Glennmont as a co-owner of one of our German offshore wind farms – said Peter Obling, director for Central Europe at Ørsted after finalizing the transaction.

– As a leading offshore wind developer in Germany, Ørsted wants to be an important part of the German Energiewende and we will continue to work to support the green transformation in this strategic market, Obling emphasized.

A farm with a fund

In May 2022, Siemens Energy announced a tender offer for the purchase of all remaining Siemens Gamesa shares. This ended in December 2022, and after a tender offer with a deadline of February 7, 2023, Siemens Energy owned approximately 98% of Siemens Games shares. On February 14, 2023, Siemens Gamesa shares were delisted from Spanish stock exchanges.

– This third investment in German offshore wind with Ørsted continues and strengthens our successful partnership, emphasized Francesco Cacciabue, CFO and partner at Glennmont Partners from Nuveen, noting that “Ørsted is a recognized leader in the offshore wind sector, and this acquisition “underscores Glennmont’s strategy of investing in the highest quality projects and developing long-term strategic partnerships with industry leaders.”

The transaction is expected to close in the coming months, subject to regulatory approvals.

Risks in the production of offshore wind farms

Observation and analysis of changes in the offshore wind energy market are instructive because they may also take place on the Polish MEW market. As you can see, this is a market with high demand for funds.

There is still great competition there, which is increasingly limited by the consolidation of production chains with companies managing personnel, management and service services, and O&M.

The high value of the project, recession, difficulties in obtaining qualified labor and changes in global logistics under the pressure of local wars increase the investment risk. Today, there is a need to identify new risks and situations that will increase investment costs and disrupt investment implementation schedules.