Brexit in the UK docks. UK seaports under pressure from recession, Covid and Brexit

By Marek Grzybowski

By Marek Grzybowski

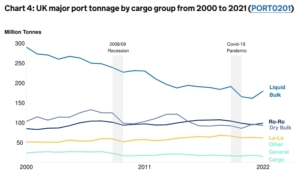

British ports found themselves on a slippery slope after the 2008-2009 crisis. After the UK left the EU and the Covid pandemic, they operated with varying degrees of success. In some ports, transshipment even increased. And since ports are a mirror of the economy, a review of their statistics gives a good idea of what is happening to Albion’s economy after leaving the European Union.

Let’s look at the years 2019-2023. In the next quarter of 2023, British ports will see a reduction in the supply of import and export cargo. As a result, transhipment remains down by 6% in the second quarter of this year, and the supply of cargo delivered and transported by sea still remains below the levels of 2022 and 2019.

– There are indications that the supply of goods will probably not reach the level of 2019, i.e. after Great Britain (UK) leaves the European Union (EU), informs the Department for Transport (DfT).

GDP has fallen by 12% since 2019

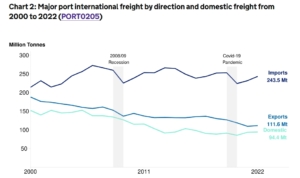

This is not a surprise, as the Office for Budget Responsibility (OBR) analysis on Brexit assumed that trade between the UK and the EU would be approximately 15% lower in the long run than if the UK remained in the EU.

The latest OBR studies on the impact of Brexit on trade in the United Kingdom, published in March 2022, also show that the United Kingdom is an economy operating less actively in international trade than until 2019. As a result, the share of trade in gross domestic product (GDP) has fallen by 12% since 2019. This is the largest decline in trade among all G7 countries, notes the DfT.

This year passenger traffic between Albion and the Continent revived. Passenger vehicle transport is subject to seasonal changes in supply. Passenger vehicle traffic on ferries is increasing. In the second quarter of 2023, there are 20% more tourists compared to the winter low recorded at the beginning of the year.

The disparity in passenger traffic compared to the same quarter of 2019 has also narrowed since last year, to just 9% compared to the second quarter of 2019. This represents the lowest percentage difference since the pandemic. This is the result of the increased activity of people crossing the border in their own cars.

Liquid and bulk cargoes are negative

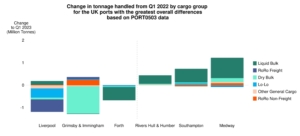

Liquid cargo supply at major UK ports in April to June 2023 fell by 2% to 43.4 million tonnes compared to the second quarter of 2022. Milford Haven had the largest decline of all major UK ports – 0.9 million tons. tons (decrease by 10%).

Tees and Hartlepool saw their liquid cargo supply increase by 0.8 million tonnes (26%) over the period. This is the largest increase in liquids handling compared to any major UK port. However, this increase compared to last year is largely due to the significant decline in crude oil exports seen in Tees and Hartlepool in the second quarter of 2022.

In the second quarter of 2023, dry bulk supply decreased by 9% to 22.1 million tonnes compared to the same quarter of 2022. This was largely driven by the decline in demand from the Albion economy. As a result, the number of bulk carriers docking with deliveries in major UK ports has decreased.

The ports of Grimsby, Immingham and Liverpool recorded a significant decline in bulk transhipments. In total, in the second quarter of this year 1.3 million bulk tons were accepted, which meant a 60% reduction in deliveries at bulk terminals.

Containers are a plus

The supply in lo-lo terminals in the second quarter of 2023 did not change much compared to the second quarter of 2022. It decreased only by less than a percent to 15.9 million tons. However, comparing the second quarter of 2023 with the first quarter of 2023, deliveries of cargo in containers increased, which was recorded by terminals reloading containers as an increase of 10%.

In the first quarter of 2023, container supply at UK container terminals was the lowest since the pandemic. The Ministry of Transport believes it was probably due to low demand for finished goods. This was caused by high inflation and rising costs of living, as well as restrictions on production based on components from Asia, mainly from the PRC.

The increase in container traffic in the second quarter of 2023 may be due to the increase in consumer confidence, which, according to the GfK Consumer Confidence Index, reached the highest level in 17 months in June 2023.

This stimulated the import of consumer goods and resulted in an increase in the supply of containers. It amounted to 9% compared to the first quarter of 2023 and 5% compared to the second quarter of 2022.

Dover saves ro-ro transport

Ro-ro cargo tonnage decreased by 2% to 23.7 million tonnes compared to the first quarter of 2023 and the second quarter of 2022. The reduction in ro-ro supply was most felt by the ports of Grimsby and Immingham.

They recorded fewer loads by 0.6 million tons, which means a reduction in wheeled goods by 15% compared to the second quarter of 2022. In the same period, the number of freight units increased by 2%, which results from an increase of 44 thousand. units. This increase was due to an increase of 119 thousand. freight units served at Dover.

The number of non-freight ro-ro units increased by 7% to 2 million in Q2 2023 compared to the same quarter in 2022. The largest increases were recorded in Dover, Grimsby and Immingham. In these last two ports, compared to the second quarter of this year. an increase was recorded by 55 thousand respectively. and 45 thousand cars and buses.

The increase in the number of cars, vans and buses in Dover has been attributed to an increase in tourist traffic. There was a clear increase in the number of passenger vehicles after the lifting of Covid-related travel restrictions.

The number of non-freight units transported is still 23% lower than in the same quarter of 2019 nationwide. The 53% increase in the number of non-freight ro-ro units between Q1 2023 and Q2 2023 is explained by seasonal fluctuations.

Ports as a mirror of the economy

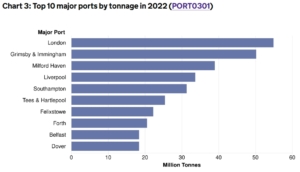

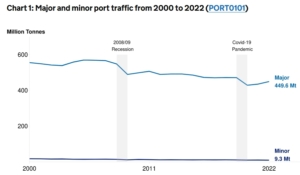

A total of 458.9 million tonnes of cargo was transhipped across all UK ports in 2022, an increase of 3% on 2021, but UK port cargo supply is still 5% lower than in 2019.

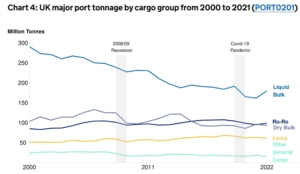

Liquid cargo, which dominates transshipment since 2000, has been on a downward trend. Only in 2022 did they increase significantly (by 11% compared to 2021) as a result of increased EU demand for crude oil from North Sea deposits. This is the result of changes in supply logistics after Russia attacked Ukraine and introduced sanctions on trade with Russia.

The supply of ro-ro cargo increased by 4% after a three-year period of decline. This is the result of an increase in tourist traffic. The reduction in dry bulk transhipments in 2022 amounted to 3.2 million tons (by 3%). However, it remained slightly above the level of 2019. Container cargo supply decreased slightly by 3% in 2022 and by 7% compared to 2019.

Even a general review of the situation in British ports is proof that the withdrawal of the British economy from the European Union had an adverse impact on the condition of this island country.