Foreign direct investment increased by 3% in 2023. Seaports as beneficiaries

By Marek Grzybowski

By Marek Grzybowski

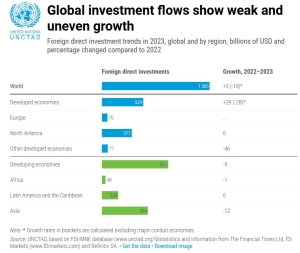

Global foreign direct investment increased by 3% in 2023, which according to UNCTAD is the result of lower fears of recession. In the maritime business, investors were active especially in the Oil & Gas sector and seafood production, tourism, maritime transport and ports. The offshore wind energy sector, however, experienced unexpected withdrawals from contracts, as we wrote about in GospodarkaMorska.pl.

Global foreign direct investment trends have exceeded previous forecasts published in early 2024, UNCTAD analysis reports. The growth was driven by several leading European economies.

Global foreign direct investment (FDI) exceeded last year’s forecasts for 2023. Estimates show that the dynamics reached 3%. Globally, this gave an estimate of USD 1.37 trillion, according to the Global Investment Trends Monitor, published by UNCTAD on January 17 this year.

A key factor was several European economies that “often act as intermediaries for FDI intended for other countries,” the report emphasizes.

– Surprisingly, after excluding these intermediary economies, global FDI flows show a sharp decline of 18% in 2023. The rest of the European Union saw a sharp decline of 23%, and the United States, the world’s leading recipient of FDI, saw a decline of 3% – they calculate UNCTAD experts.

UNCTAD analysts point out a disturbing decline in the number of inquiries regarding international investment projects last year. This is especially true for merger and acquisition financing, which dropped by 21% and 16%, respectively. During this time, greenfield project announcements declined by 6% in volume but increased by 6% in value.

“A moderate increase in FDI flows seems possible in 2024.” the report said. This optimism is based on the forecasted stabilization of inflation close to the core and reduced borrowing costs in the main markets.

Significant threats remain, including geopolitical tensions, the report states. The growing debt of many countries is also worrying. Concerns about further “fragmentation of the global economy” are not decreasing.

The Asian and African FDI engine is slowing down

UNCTAD notes that overall FDI activity in developing countries in 2023 showed a 9% decline. Investments in these countries reached USD 841 billion. The greatest decline in investment was recorded by developing Asian countries. These countries recorded a decline of 12%.

China experienced a 6% decline in FDI inflows but showed an 8% increase in new greenfield project announcements. India, another regional giant, saw a 47% decline in FDI inflows. However, this country remained in the top five global destinations for greenfield projects.

ASEAN (Association of Southeast Asian), the previously traditional direction of dynamically growing investments, has clearly slowed down. There was a 16% decline in FDI in the region. However, the region remained attractive for manufacturing investment, with a remarkable 37% increase in investor inquiries for greenfield projects. FDI is expected to grow in countries such as Vietnam, Thailand, Indonesia, Malaysia, the Philippines and Cambodia.

On the other hand, FDI inflows decreased by only 1% in Africa. They remained stable in Latin America and the Caribbean. This was due in part to an influx of investment funds into Central America and a 21% increase in FDI in Mexico, the region’s second-largest economy.

FDI in global industries

The sector analysis in the 2023 report showed an increase in the number of projects in sectors that rely heavily on global value chains, including automotive, textiles, machinery and electronics.

In turn, the semiconductor sector, after strong growth in 2022, recorded a 10% decline in the number of greenfield projects and a 39% decline in their value. Investments in the renewable energy sector also recorded declines in investment inflows. The first decline in FDI since the Paris Agreement – emphasizes UNCTAD.

Data for the renewable energy sector clearly shows a 17% decline in the number of new international project financing agreements and a 10% decline in their value. This is the first decline in FDI in this industry since the 2015 Paris Agreement.

The number of international investment projects announced in developing countries in sectors relevant to the Sustainable Development Goals (SDGs) remained relatively stable in 2023. However, the number of SDG-related projects showed a decline of 27%. This resulted in the value of international FDI contracts decreasing by 40%.

In turn, the number of greenfield projects increased by 12%. However, there was only a 6% increase in the value of investment tasks correlated with sustainable development goals. The food and agriculture sector showed marginal growth, while most other sectors recorded declines.

Tanzania and Australia ports with Chinese FDI engine

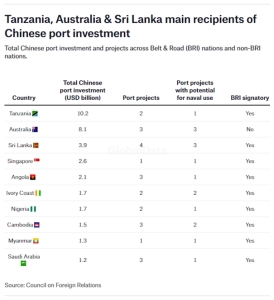

China invested $10.2 billion in Tanzania. It is the biggest beneficiary of Beijing’s activity in Asia. China has invested more than twice as much in Australia’s port infrastructure as third-placed Sri Lanka, which received $3.9 billion.

According to data from the Council on Foreign Relations, Australia is the second largest recipient of Chinese investment in ports. As of September 2023, $8.1 billion in Chinese FDI had been allocated to three Australian port projects.

What distinguishes Australia from Tanzania, Sir Lanka and the top ten recipients of Chinese investment is the Belt and Road Initiative (BRI). Australia is the only country that is not a signatory to the Chinese investment program that received such significant Chinese investment in 2023.

Chinese investments in Australia are being implemented with some problems. They are a source of political tension in Australia. The reason is periodic tensions in trade and political relations between Beijing and Canberra.

After taking office in 2022, Prime Minister Anthony Albanese ordered a reconsideration of Rizhao-based Landbridge Group’s lease of the port of Darwin in the Northern Territory. In October last year it said it was “not necessary” to cancel the Landbridge lease, but the government would monitor security arrangements at Darwin Port.

Dilemmas of Australians

Landbridge paid $506 million for the 99-year lease. Australian ($322 million) in 2015. The lease contract was signed despite US reservations. The United States had concerns about China’s ability to collect intelligence on Australian and American naval forces deployed in the region.

The agreement with the Port of Darwin is a dual-purpose use of the port. This means that Landbridge can engage in both the port’s commercial activities and military services. More than 2,500 US Marines are stationed in Darwin Harbor. The port uses the US Marine Corps to service ships and organize supplies for the military unit.

There has also been pressure on the Australian government to buy back the port of Newcastle, north of Sydney, which is partly owned by China Merchants Port Holdings Company. Similar talks were held regarding the port of Melbourne. Australia’s most active port was acquired for A$9.7 billion ($7.3 billion) in 2016 by a consortium backed by a consortium of investors including China Investment Corp.

Arab capital in Tanzania and Pakistan

DP World’s larger investments this year. there was a contract with the Tanzania Ports Authority to take over the operation and modernization of four quays in the port of Dar es Salaam. The contract was signed for 30 years. DP World’s $250 million investment will constitute the first phase of a broader investment plan.

Over the life of the concession agreement, this value could reach up to USD 1 billion, including inland logistics development projects. The idea is to develop the port’s infrastructure connections with Sub-Saharan Africa via new road and railway networks.

As part of the framework agreement with Pakistan, an economic zone will be established in Port Qasim, which is expected to attract foreign direct investments worth over USD 3 billion. The statement said that “DP World, on behalf of the Government of Dubai, will implement the development of the economic zone with the aim of maximizing economic activities in Pakistan.”

As the example of Australia shows, foreign direct investment is a strong impulse to strengthen economic infrastructure. However, in times of political tension, questions are raised about the source of funds and strategic goals of investors. Undoubtedly, building a competitive advantage based on your own resources is not possible.

Even among the strongest economies, external investors are expected to be active, and FDI in many cases is also an impulse to build more lasting relationships with new markets. Let’s not be afraid of FDI, because investments are the driving force of regions.