The business of oil, gas and wind. Equinor with profits in 2023 and prospects until 2027

By Marek Grzybowski

By Marek Grzybowski

Equinor (OSE: EQNR, NYSE: EQNR) generated a profit of USD 8.02 billion in the third quarter of 2023 thanks to excellent production diversification. After taxes, $2.73 billion remained. Net operating profit in the second quarter of the current year. amounted to USD 7.45 billion and net profit was USD 2.5 billion. In the second quarter, profit of USD 7.54 billion and USD 2.25 billion. After tax, net operating profit was USD 7.05 billion and net income was USD 1.83 billion. In 2022, the company’s companies contributed USD 44.3 billion to the Norwegian budget, CFO Torgrim Reitan announced in December 2023.

Equinor will take the Empire Wind projects forward on a 100% ownership basis and will continue to develop its strong offshore wind organization in the US. Bp will take the Beacon projects forward on a 100% ownership basis in 2024.

“We aspire to be a leading company in the energy transition. Building on our experience as a leading player in US offshore wind, we now take full ownership of a mature, large-scale offshore wind project in a key energy market, where we have built a strong local organization,” says Pål Eitrheim, executive vice president of Renewables in Equinor.

“We aspire to be a leading company in the energy transition. Building on our experience as a leading player in US offshore wind, we now take full ownership of a mature, large-scale offshore wind project in a key energy market, where we have built a strong local organization,” says Pål Eitrheim, executive vice president of Renewables in Equinor.

The good results – good info for shareholders

Shareholders were satisfied with the good results. In the second quarter of last year the cash dividend reached USD 0.30 per share, and the extraordinary cash dividend reached USD 0.60 per share. Shareholders received identical information after the third quarter of 2023. Thanks to these results, the third and fourth tranches of share buyout were possible. Each worth $1.67 billion.

Commenting on the results of the third quarter of last year. Anders Opedal, president and CEO of Equinor ASA, stated that: “Equinor delivered good cash flow and earnings in the quarter with significantly lower gas prices than last year. Thanks to good operational results, we have ensured high oil production from the Johan Sverdrup field and international portfolio.”

Commenting on the results of the third quarter of last year. Anders Opedal, president and CEO of Equinor ASA, stated that: “Equinor delivered good cash flow and earnings in the quarter with significantly lower gas prices than last year. Thanks to good operational results, we have ensured high oil production from the Johan Sverdrup field and international portfolio.”

Lower gas production from the Norwegian continental shelf was influenced by planned maintenance works and extended downtime.

In the third quarter, Equinor generated oil and gas production of 2,007 b/d (barrels per day), of which 879 b/d of gas. This was less than in the same quarter of 2022, when 2,021 b/d was achieved, including 1,009 b/k of gas. Production was higher than in the second quarter of 2023, when it amounted to 1,994 b/d, including 902 b/k of gas.

The good results are based on drilling activity in the Johan Sverdrup field on the Norwegian Shelf (NCS), production of the Vito field in the US, the Peregrino field in Brazil and the inclusion of the Buzzard field in the UK in the portfolio. In October 2019, Equinor and the Johan Sverdrup partnership, which includes Lundin Norway, Petoro, Aker BP and Total, began production from a field in the North Sea.

Oil and gas from under the sea

The Johan Sverdrup field will generate production income of over NOK 1,400 billion, of which over NOK 900 billion has been calculated to flow into the Norwegian budget. Oil reserves were estimated at 2.7 billion barrels of oil equivalent. You will be able to obtain up to PLN 660,000. barrels of oil per day at the peak of production from the field.

And most importantly, “the break-even price for developing the entire deposit is less than $20. per barrel. As of 2020, operating costs are below $2 per barrel.”

In 2023, gas production was impacted by planned maintenance and unplanned extended downtime at the Troll A platform and the Nyhamna gas processing plant. Due to unplanned losses, it was estimated that production in 2023 will be higher only by approximately 1.5% compared to the results in 2022.

The production of electricity from renewable sources in the third quarter of this year amounted to 373 GWh, compared to 294 GWh in the same quarter last year. The increase was driven by higher production from UK wind farms and new production from onshore renewables in Poland, as well as the Hywind Tampen floating wind farm operating at full capacity. Taking into account gas-to-energy conversion in the UK, total energy production in Q3 2023 was 883 GWh.

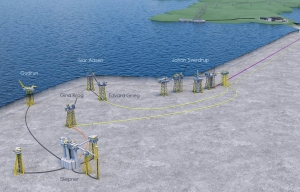

For comparison, the Hywind Tampen floating offshore wind farm operating on the Norwegian shelf generated energy already in the fourth quarter of 2022 and was completed in 2023. Production from renewable energy sources amounted to 517 GWh in the second quarter, a decrease of 2% compared to the same quarter of 2021. Taking into account the conversion of gas into energy, the total electricity production in the second quarter was estimated at 1,332 GWh, so it was much higher than in the third quarter of 2023.

Diversification of the oil portfolio

Equinor continues to diversify its production and develop its portfolio of renewable energy and low-carbon solutions. At the same time, it does not give up on profitable oil and gas projects characterized by low greenhouse gas emissions from production.

Anders Opedal emphasizes: “We continue our transformation, harnessing the first energy from Dogger Bank in the UK – the world’s largest offshore wind farm, continuing to develop onshore renewables in Brazil and Poland, and investing in Bayou Bend CCS (carbon capture) and Storage in USA. With the approved Hammerfest LNG electrification plan and the launch of shore power for Gina Krog, we continue to reduce our own emissions.”

Dogger Bank A, the world’s largest offshore wind farm, began production in October on the UK shelf. This is expected to contribute to energy security and the decarbonization of the UK energy system.

The Rosebank oil field in the UK’s economic zone has received government approval to drill and start producing oil in 2026–2027. With total deepwater resources of approximately 245 million barrels, the deposit is expected to enhance production and value creation on the UK continental shelf and for Equinor.

– The Rosebank field is located mainly in square 213/27a in the Faroe and Shetland Basin. It is a large body of water approximately 130 km west of the Shetland Islands. Located at a depth of approximately 1,100 m (3,600 ft). The hydrocarbons are arranged in an elongated, four-way anticlinal structure with a south-easterly direction, reports the Geological Society.

Business in the wind and CO2

– Offshore wind projects in the U.S. Northeast are negatively impacted by cost inflation and supply chain constraints, Equinor management justifies the decision to withdraw from the project and explains that “The New York State Public Utilities Commission rejected petitions from Equinor and other companies to raise prices.”

In the third quarter of last year Equinor acquired shares in Bayou Bend CCS LLC, a company prepared to implement one of the largest carbon capture and storage projects in the USA. In the same quarter, Equinor drilled 5 offshore exploration wells and made 2 commercial discoveries. At the end of the quarter, drilling of 12 wells was continued.

Equinor posted a strong adjusted profit of $8.02 billion. The Marketing, Midstream and Processing (MMP) segment achieved particularly good results. Earnings were $876 million above the guidance range for adjusted earnings in the third quarter. The sale of crude oil and trade in petroleum products turned out to be extremely profitable. The economic result was significantly influenced by the optimization of the forwarding portfolio and high refining margins.

Equinor has entered into a swap transaction with bp, under which Equinor will take full ownership of the Empire Wind lease and projects and bp will take full ownership of the Beacon Wind lease and projects – informed Equinor.

Under the agreement, Equinor will take 100% ownership of Empire Offshore Wind Holdings LLC. Subject to certain conditions, Equinor will also take over bp’s 50% share of the South Brooklyn Marine Terminal (SBMT) lease. Bp will take over Beacon Wind Holdings LLC and the associated project company that holds the Astoria Gateway for Renewable Energy site and will become the operator of the Beacon Wind projects. The transaction will be cash neutral, except for standard settlements of cash and working capital items.

“Empire Wind 1 is ready to deliver on New York’s climate and energy goals, with numerous permits and supplier contracts secured. The strong commitment by the state to develop this industry is reflected in the NY4 rapid rebid offering, providing an opportunity to improve value creation for the project,” says Molly Morris, senior vice president for Renewables in the Americas in Equinor.

“Empire Wind 1 is ready to deliver on New York’s climate and energy goals, with numerous permits and supplier contracts secured. The strong commitment by the state to develop this industry is reflected in the NY4 rapid rebid offering, providing an opportunity to improve value creation for the project,” says Molly Morris, senior vice president for Renewables in the Americas in Equinor.

Good financial results

In the third quarter, Equinor recorded net impairment losses of USD 971 million. This was mainly due to impairment losses on assets in the NCS segment in the amount of USD 588 million and in the MMP segment in the amount of USD 346 million.

In the Renewable Energy segment, the impairment loss amounted to USD 300 million. This was partially offset by the reversal of a $290 million impairment loss on assets in the US Gulf of Mexico.

Cash flow from operating activities, before taxes and including working capital, amounted to USD 11.3 billion in the third quarter.

In 2022, Equinor group companies contributed USD 49.2 billion in the form of taxes and license fees to the budgets of the countries in which the company operates. Of this, USD 44.3 billion was paid to the budget of Norway, where Equinor conducts most of its business projects.

In 2023, Equinor paid a tax installment of $3.67 billion based on calculations of expected 2023 earnings. In October last year an additional installment of USD 930 million was paid, and in the fourth quarter two ordinary installments of USD 3.75 billion were paid to the budget.

Investment outlays in technical infrastructure in the third quarter of this year. amounted to USD 2.64 billion, and total capital expenditure reached USD 3.21 billion. After taking into account taxes, shareholder capital distribution and investments, net cash flow for the entire third quarter was USD 1.48 billion.

Sources: Equinor BP, Bayou Bend CCS LLC