India – a new player on the maritime routes of oil and refinery products

By Marek Grzybowski

By Marek Grzybowski

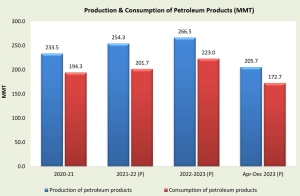

India caught the wind in its refining sails after introducing sanctions on trade with Russia and limiting the import of Russian oil by EU countries. 2022 was a particularly good year for business. 2023 was not too bad either. According to data published by the intelligence company Kpler, oil imports to India increased to 5.2 million barrels per day in March 2024.

This is the highest level since the beginning of 2020. The demand for seaborne crude oil imports is driven by the increased activity of refineries in India. It is through them that Russian oil is transferred to EU countries in the form of refinery products. Imports were 11% higher in February y/y and 4.5% in March 2023, thus strengthening Moscow’s position as a major supplier as refiners reduced purchases from the Middle East, notes Nidhi Verma, Reuters correspondent from India.

In the middle of last year India was the third largest importer and consumer of oil in the world. “They emerged as the main buyer of discounted Russian seaborne crude oil after Western countries stopped buying [crude oil and refined products – MG] from Moscow following its invasion of Ukraine,” Verma says.

India benefited from the disruption in supplies of refined products from Russia and significantly increased its supplies to the European Union. – In March this year. India exported 304,427 barrels per day of refined petroleum products to Europe, down 6.5% from February. Exports to Asia also fell by 22% during the month to 308,740 barrels per day, reports Financial Express. The decline in deliveries to Europe is explained by the extension of the supply route after the blockade of the passage through the Red Sea.

The global oil market is on a roll

In the global oil market, 2023 was another good year for crude oil trading. This was despite high oil prices and an economic slowdown in many markets.

– In the period January–December 2023, the global supply of crude oil [in maritime transport – Ministry of Economy] increased by 5.7% y/y and reached 2,167.2 million tons in maritime trade – according to data obtained based on observations of tanker traffic by Refinitiv Marine, says Banchero Costa Research in its analyses.

In the corresponding period of 2022, 2,050.9 million tons were transported between fuel terminals, and in 2021, only 1,886.3 million tons were loaded on tankers. In 2019, slightly more crude oil was transported via sea routes, as the volume exceeded 2,110.5 million. vol.

– Oil supply from Persian Gulf wells decreased by 0.9% in 2023. y/y to 872.8 million tons. However, it still constituted a significant share in the global market for this raw material, as it accounted for 40.3% of global maritime trade – reports Banchero Costa and calculates that exports from Russian ports increased last year. by 5.4% y/y to 230.4 million tons, which constitutes 10.6% of global crude oil turnover between fuel terminals.

US exports increased by 19.1% y/y to 196.6 million tons in the period January-December 2023. From West Africa, exports increased only by 2.8% y/y to 175.5 million tons. Supply increased significantly oil from South America. Exports from this region increased by 21.8% y/y to 158.9 million tons. Exports from Northwest Europe (Norway and Great Britain) increased by 3.5% y/y to 111.1 million tonnes.

The largest maritime importer of crude oil in 2023 was the economy of the People’s Republic of China. 23.7% of global crude oil imports were imported through China’s port terminals. The volume of oil sales to China increased by 16.6% y/y from 439.9 million tons in 2022 to 512 million tons in the period January-December 2023.

In 2023, imports to the EU27 increased by 4.5% y/y. Tankers transported 471.6 million tonnes to EU ports, and the share of European Union countries reached 21.8% of global crude oil trade. To ASEAN countries, imports increased by 14.9% y/y to 241.2 million tons. To South Korea, imports increased by 2.7% y/y to 140.4 million tons, while Japan’s imports decreased by 8% y/y up to 121.6 million tons.

India is a beneficiary of turmoil

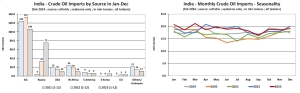

In March this year crude oil imports from Russia increased to 1.8 million barrels per day, the highest since July last year. Large supplies of Urals oil reached Indian ports. However, imports were slightly lower, as a year ago they imported 1.87 million barrels per day at the same time.

“India’s large oil imports are partly a signal of increased oil production by refineries, although we have also seen a slight increase in onshore oil stocks this month,” said Serena Huang, manager of APAC Analysis at Vortexa, quoted by Financial Express. – Imports of Russian oil to India are likely to remain high in the near term, Huang predicts.

Russia has become the main supplier of crude oil to India from 2022 thanks to significant price reductions. Despite this, the share of Russia’s supplies in India’s total imports fell to 34.5% in March 2024. The peak of deliveries with a share of 45% was achieved in May 2023. At that time, the import volume was 2 million barrels per day. Russia’s share in oil supplies to India increased to 32.5% in February this year.

India is currently the world’s fourth largest seaborne crude oil importer. They are overtaken by the economies of the People’s Republic of China, the EU and ASEAN. In 2023, India accounted for 10.5% of the world trade in crude oil transported by sea, calculate experts from Banchero Costa.

Imports by sea to India increased by 1.8% y/y, from 223.9 million tonnes in 2022 to 228 million tonnes in January-December 2023. In 2021, India imported through ports 200.7 and 198, 1 million tons of crude oil in 2020 In 2019, India imported over 212.6 million tons by sea.

About 44% of the crude oil delivered to Indian ports in 2023 was delivered by VLCC tankers, about 31% was delivered by Suezmax ships, and about 25% arrived in Aframax tanks.

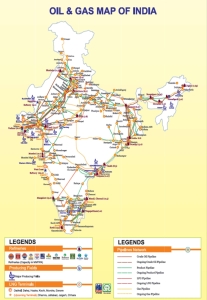

The most important ports in India through which crude oil was imported in 2023 are: Jamnagar, through whose terminals 65.8 million tons were pumped, Vadinar (44.8 million tons) and Paradip (31.9 million tons). Smaller volumes of oil were delivered through terminals in the ports of Mundra (19.9 million tonnes), Mumbai (17.5 million tonnes), Cochin (16.3 million tonnes), Visakhapatnam (10.4 million tonnes), Chennai (10 million tonnes ), New Mangalore (7.4 million tonnes), Mangalore (2.6 million tonnes).

India has quickly adapted to changes in the global oil supply market. Operators and refineries took advantage of the situation after the introduction of sanctions by European and North American countries.

Banchero Costa reports that “India’s imports by sea from Russian ports increased by 126.6% y/y, from 33.3 million tons in 2022 to 75.4 million tons in 2023. There are deliveries twenty times higher than in 2021. , when tankers delivered only 4.1 million tons of crude oil from Russian ports. In 2022-2023, in addition to Russian oil, India will also receive oil of non-Russian origin, e.g. from Kazakhstan.

From Russian ports through Indian refineries to the EU

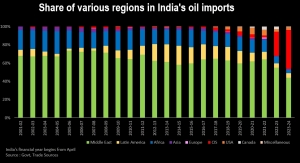

Russian ports have now become the second largest source of oil supplies to India by sea. They provided 33.1% of the oil imported by India in 2023. The main supplier is still the operators from the Persian Gulf (46.6%). The US provides India with only 4.6% of its oil demand and West Africa with 4.5%.

Supplies from the Persian Gulf to India in 2023 decreased by 20.2% y/y to 106.2 million tonnes. Of this, 48.2 million tons came from Iraq (less by 6.5% y/y), 34 million tons were imported from Saudi Arabia’s oil fields (less by 15.4% y/y), and 12.3 million tons came from from the United Arab Emirates (increase by 43.8% y/y).

Imports from the USA decreased by 33.3% y/y to only 10.5 million tons in 2023. Supplies from West Africa to India decreased by 44.3% y/y to 10.2 million tons. The largest oil supplies to India they arrived last year. from the port terminals of Basra (48.1 million t), Ras Tanura (33.3 million t), Primorsk (27.4 million t), Ust-Luga (19.6 million t) and Novorossiysk (17.2 million t) .

Where does India’s demand for oil from Russia come from? Well, refineries in India are working at full capacity. A team of experts from an analytical company from Europe found that more than one-third of India’s exports of petroleum products to the G7 and EU countries came from Russian oil. This happened when a group of G7 and EU countries imposed price ceilings on Russian crude oil, but not on refined products. Then, among others India’s Jamnagar refinery, run by Reliance Industries Ltd, played a significant role. The refinery was operating at full capacity, exporting petroleum products worth EUR 5.2 billion to EU countries.

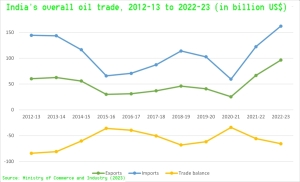

According to data from the government website Niryat, exports of chemical and petroleum products in the period April–December 2023 reached the value of USD 59.16 billion. In the same period of 2022, these products were exported for USD 67.64 billion. Before Russia invaded Ukraine and imposed sanctions in April-December 2021, the value of India’s exports of chemicals and petroleum products amounted to $44.28 billion.

Profits from exports to Europe, North America and the CIS region increased. This comes as the total export value of petroleum products stood at $67.11 billion in the first 10 months of the current fiscal year. A year earlier it was even better, as exports generated USD 75.65 billion.

As you can see, the Indian refining industry quickly adapted to the new situation and took advantage of the turmoil in the oil market to increase production and sales. The European chemical industry, after reducing supplies from Russia, held its breath only for a moment. Production quickly adjusted logistic chains, and the Indian refining industry turned out to be the beneficiary of this maneuver.